One of the most frustratingly difficult concepts to convey to novice traders is that the technical analysis process need not be tedious or confusing at all.

One of the most frustratingly difficult concepts to convey to novice traders is that the technical analysis process need not be tedious or confusing at all.

Honestly, this trading “puzzle” should be the simplest and easiest piece, but for many traders it’s just the opposite…

They start with dozens of indicators on charts, open 20 different websites on their computers, and attempt to analyze literally hundreds of different variables simultaneously. They use all this to try to find a trading advantage. Something that provides them with a ‘clue’ as to what happens next in the market.

guess what? This trading edge is right in front of them, hidden under a pile of unnecessary distractions on the chart. That edge, of course, is price action analysis.

So don’t waste your time thinking that there is a “holy grail” trading system based on indicators or software that turns your computer into an ATM. With over 18 years of live trading experience, all you need to effectively analyze price charts is your eyes, your computer, and the raw price action data that the market provides for free. caffeine.

But if you’re still not convinced that price action is all you need to analyze the market, one of the following points may help you “knock” some sense.

1. Clean vs Messy

As made clear in the Price Action tutorial, one of the main reasons for learning to read Price Action is to keep your charts organized and free of confusing and cumbersome indicators so you can trade in a simple, ‘naked’ way. is to

The trading world is already filled with a myriad of conflicting and confusing advice, methods and approaches. So one of the biggest steps you can take very easily to stay ahead of other traders is to simply get rid of all the “garbage”. your chart. Simply put, there is absolutely no need to trade with indicators.

All beginner traders are advised to start by learning to map the charts clearly and learning to listen to the market simply by learning to trade by interpreting price action. It’s important to simplify the analysis part, but most traders do just the opposite. They overcomplicate it.

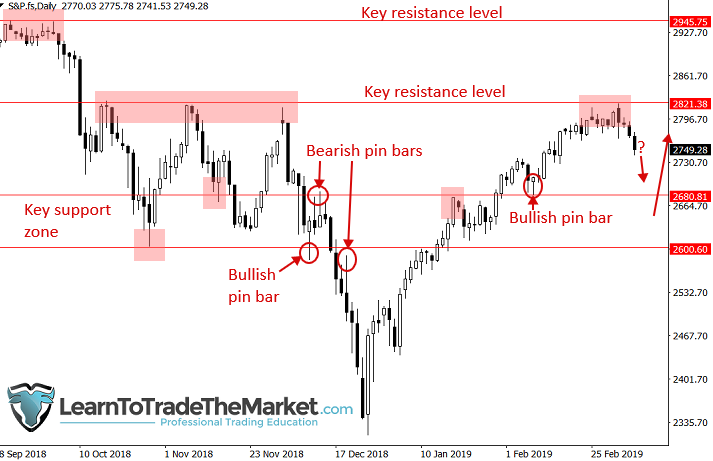

Take a look at the example chart below and see all that can be learned just by analyzing the price chart without the BARE indicator.

Using the above price action data, you can formulate a predictive trading plan. This effectively gives you a “window into the future” so that you can plan your next move. You may need to wait for a pullback to the support zone and look for a buy signal for price action, as seen on the far right of the chart above.

2. No news is good news

One thing I feel very strongly about is also the great benefit of learning to read price action. By doing so, it means that you can ignore all news and other unnecessary trading variables. As you can see, price action reflects all the news and all other variables that affect it.

Fewer variables to analyze means that many traders take in more and try to “get it”, avoiding the “analysis paralysis” that hurts many traders. When trading on price action, he only needs to care about three main components: trends, levels and price action signals.

As I wrote in my other lesson discussing why I don’t trade the news, most of the time when trading news is announced the actual movement from it has already happened. It has to do with the “buy the rumor sell the fact” effect that occurs in markets when players predict what will happen when an XYZ event is released or held. What appears to be a logical price direction as a result of an event is not the direction in which it will move, but sometimes it is. Therefore, trying to gain an ‘advantage’ by ‘predicting’ market movements based on news, especially before or before the news, where price action suggests the next market move. It’s really a waste, especially when it’s likely.

3. Price action is the language of money

Price action gives us the best insight into the psychology of people trading the market. In fact, all the price movements you see on charts are really just human psychology unfolding through the market. What one trader thinks is a good place to buy is what another trader thinks is a good place to sell, etc. If more people think buying is the right move, The price goes up and goes down if more people think selling is the right move. So cut out the ‘middlemen’ (variables other than price action) so to speak, and learn to read the ‘language’ of money staring at you on the chart.

Therefore, if the price covers all the beliefs and views of all market participants and at a particular point in time, reading the price bars on the chart will tell us what the market participants are saying and what they are saying. You can read what you are trying to do. Let’s see an example:

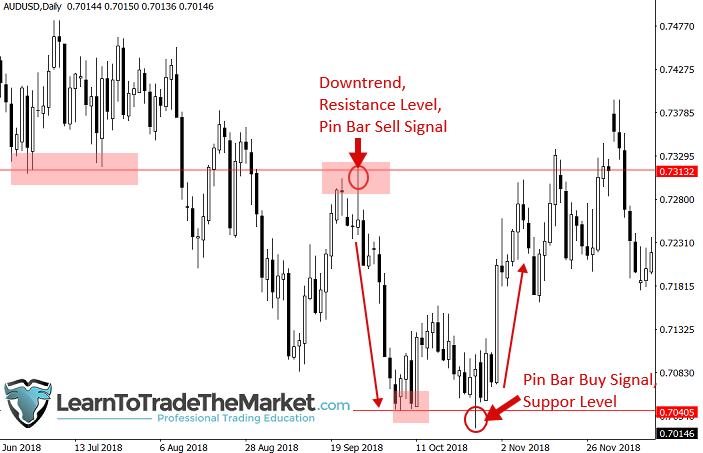

In the chart below, we can see it with a bullish pinbar. The bears pushed the price down at first, but buyers saw it as an opportunity and bought the decline more aggressively. Indicates that the price may rise soon. A bearish pin bar shows the opposite. Sellers are winning and prices are getting “heavy” or bearish…

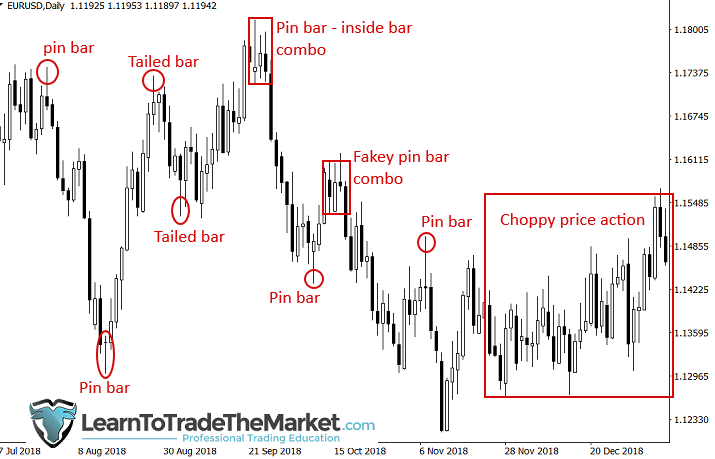

4. Price action can identify clear trading signals and recurring patterns

If you know how to read the raw price action on the chart, there is also a complete trading strategy that gives you a high probability of getting an edge while providing a defined set of entry and risk management rules.

For example, if you have a clear pin bar signal at the key chart level, ideally within the trend, you are provided with a “big 3” factor of confluence: trend, level, signal or TLS. Not just an entry, but an “embedded” risk management strategy. Stop loss placement is based at least in part on signal bars and surrounding levels, from which position sizes and profit targets are set.

To better understand how the TLS strategy works easily and effectively, take a look at the chart below.

A simple set of parameters: trends, levels and signals can provide setups for some highly probable repeated price actions.

A self-study of charts reveals that price action signals and other price action patterns tend to repeat themselves over time. As you identify these signals in real time, start developing your trader intuition and intuition, and start trusting yourself, more and more of these signals and patterns will start popping out. It’s as if the market is “speaking” directly to you…

5. A minimalist approach is often best

Minimalism is a way of life for some people and I am very drawn to this and try to model it in different ways in my life. means to be Most people buy things they don’t need and eventually realize they don’t want them. The results are as follows. “Things” don’t make you happy. Time, freedom, spending time with loved ones and not having to worry about money all the time. These things make you happy.

What does this have to do with trading? All.

I wrote an article on a minimalist guide to trading that you should definitely read. Thinking less, analyzing less, and trading less is ultimately the catalyst for successful trading. Interactions with the market should be kept to a minimum. This ranges from how many trades you enter, to how often you check after it goes live, to how many times you open the chart. Less is More, that’s how you make money faster, trust me.

Conclusion

In the early days of learning how to trade, I honestly felt lost. There is so much information out there, much of it I would call “misinformation”. A novice trader must be able to filter the “good from the bad” very well to know what is worth spending time on and what is worth spending time on. it’s not.

After researching almost every indicator and trading system under the sun and realizing they didn’t work as advertised, I eventually went back to plain and simple price action trading. I quickly realized that I didn’t need all the other “junk” on my charts, just getting in the way of a true view of the market. price action.

I’ve been trading price action for over 15 years and it’s proven time and time again. Simple but very effective and you don’t have to look at other variables. You just need to know how to read it, because everything is truly reflected via price movement.

Since 2008, the trading tutorials I’ve been creating for students are the exact type of real-world educational resources I wish I had access to when I started trading years ago. If you apply yourself, read price action bar by bar, and stick to the core philosophy of keeping your overall trading method simple, your chances of success in the professional trading world increase significantly.

This blog, along with the hundreds of trading lessons I’ve authored and my Professional Price Action Trading Course, will dramatically accelerate your knowledge and help you achieve trading success faster.

Cheers to future trading success, Nial.

Leave a comment below with your thoughts on this lesson…

If you have any questions, please contact us here.