Over the past few days, Avalanche has suffered heavy losses, plummeting almost 20%. In the weekly timeframe, AVAX lost his 10% of market value. The daily timeframe shows AVAX rising slightly on the chart with his 1.6% gain, but Avalanche’s technical outlook remains bearish.

While sellers are dominating the market, buyers are wary of price action, with both demand and accumulation on the daily chart declining. For Avalanche to see some easing in price, it needs to be above $18.

However, the $17 price level is acting as a supply zone for altcoins.If the bulls are unable to defend the altcoin’s current price, the bears may gain complete control over the price of the asset.

Like other prominent altcoins, major market movers have struggled to break through key resistance levels.AVAX’s declining market cap indicates less buying pressure in the market.

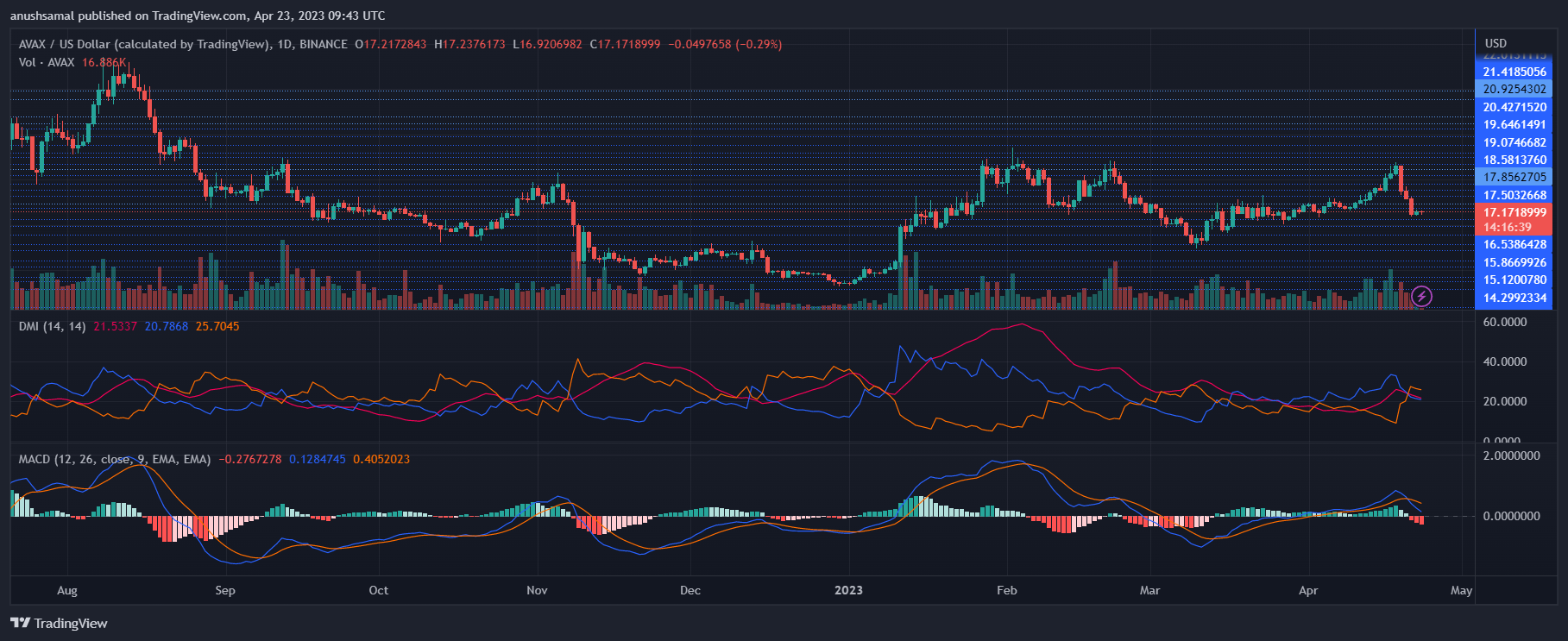

Avalanche Price Analysis: 1 Day Chart

At the time of writing, AVAX was priced at $17.17. The altcoin’s immediate resistance is at $18, and breaking it could lead to a push to $19, thereby strengthening the bull market.

However, if Avalanche continues to trade flat, we expect a break below $17. In such cases, the next support level for the asset was $15.

The altcoin recovery hinged on buyers stepping in to push the price above $18. His recent AVAX trading volume is red, indicating that selling pressure is building in the market.

technical analysis

Over the past week, demand for altcoins has dropped significantly, driving their value down. Despite the efforts of bullish investors to regain buying strength, it is imperative to overcome immediate resistance to move forward.

The Relative Strength Index shows that sellers are outnumbering buyers and the index is below 50. A slight uptick was seen, but the bearish influence continues to dominate.

Moreover, AVAX price remains below the 20 simple moving average line, indicating that sellers are gaining momentum and are leading the price action in the market.

Moreover, further technical indicators suggest bearish momentum prevails. The Moving Average Convergence Divergence indicator shows price momentum and reversals in the market. On the 1-day chart, a red histogram has formed, indicating a sell signal.

The Directional Movement Index determines the price direction. The -DI line (orange) is now above the +DI line (blue), so the DMI reading is negative. The Average Directional Index (red) is above the 20 mark, indicating strong price momentum.

Featured image from UnSplash, chart from TradingView.cometers