There is so much more to trading than just opening a chart and looking for entry signals. In fact, (don’t tell anyone this), a good price action trader knows very well how to set up and analyze his charts, so that his entries show price action “patterns” or “signals.” ” may not even be necessary. In fact, potential market biases defined by the structure of the market—trends, key horizontal levels, etc.—often provide enough clues to spot potential entries. Therefore, learning to identify and plot these parts of the technical analysis “puzzle” is very important.

There is so much more to trading than just opening a chart and looking for entry signals. In fact, (don’t tell anyone this), a good price action trader knows very well how to set up and analyze his charts, so that his entries show price action “patterns” or “signals.” ” may not even be necessary. In fact, potential market biases defined by the structure of the market—trends, key horizontal levels, etc.—often provide enough clues to spot potential entries. Therefore, learning to identify and plot these parts of the technical analysis “puzzle” is very important.

Today’s lesson basically explains how to do the daily and weekly chart analysis that you can see in the market commentary. The main pieces of this puzzle are: clean black and white price charts, key levels, trends, price action, market biases and signals. As a result, these things are the main focus when conducting analysis and market commentary. Because learning how to properly map the market is essential to understanding how to properly trade on price action.

Why I use “clean” charts and how to set them up

Clean charts, or charts without indicators, are the backbone of my technical analysis and price action approach. If you’re not sure why I prefer clean, bare price charts, check out my article on why indicators ruin your trades. Needless to say, I subscribe to the simple, less is more trading philosophy, and for some very good reasons, I’ve written about it frequently.

If you haven’t used a clean, indicator-free price chart yet, you should check out our excellent tutorial on how to set up your chart here.

Here’s an easy way to properly set up your chart.

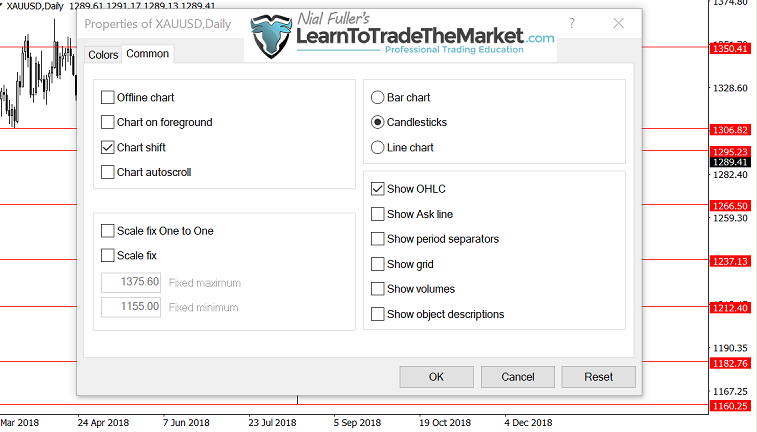

First, right-click the graph and select[プロパティ]Choose. When you do this, you will be presented with the following screen of chart options. First, set how you want to set the colors and other options for this image.

Then select Common and set the options as follows:

This is a basic overview of how to quickly set up a candlestick chart exactly like mine. Remember, we made it easy for a reason. Simpler is better for trading, so we try to eliminate variables that can cause confusion, doubt, fear, etc.

How to analyze clean price charts

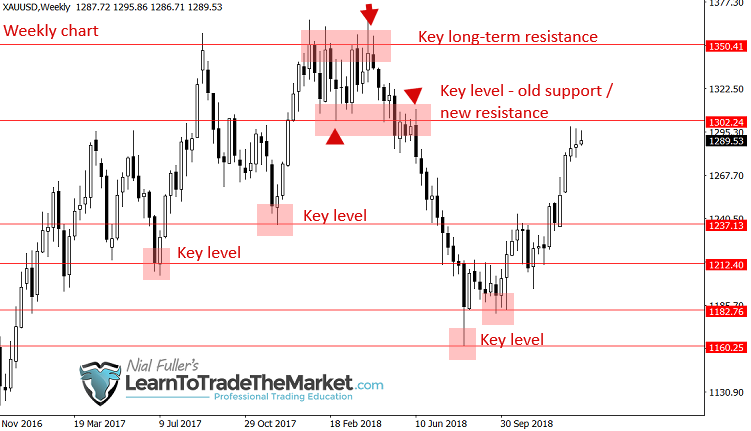

When writing a weekly member market comment, the first thing to do is zoom out on the weekly chart. This is because we want to see the big picture. This will give you a good idea of what happened and how it affects what. is happening now.

Note that the chart below zooms out to a weekly view of the current gold chart. We have marked the most obvious major levels of support and resistance. Note that often these levels will “flip” from support to resistance and vice versa as the price moves up and down.

Note that in the chart image below, we have zoomed out. So we are looking at last year’s data on the daily chart. This gives you ample time to see last year’s levels and trends and how the price action led to the current point. These are the levels that I consider most relevant, the areas of consolidation and trend price action. These are the first things I look for when calculating prices. Action analysis…

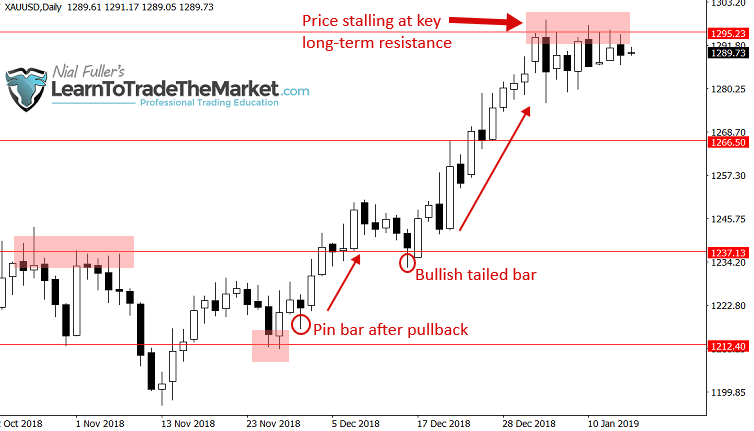

In the chart below, we’ve zoomed in a bit more, but you’ll notice the same levels. Here we analyze it in a little more detail.

First, notice the bullish tail bar on the far left of the chart. This was clearly an important turning point from a downturn to an uptrend. So we draw a horizontal level at the low of that bar. If the price drops that far, this level will be appropriate again. The informed price then entered a flat adjustment period for almost two months before breaking out and exiting. However, after the breakout, the price rose slowly to form a bearish pinbar at the 1237.00 area. Resistance levels previously marked on the chart. Now, this is considered a ‘countertrend’ pinbar, something we usually don’t like, but because it was already at a significant level on the chart with a clear target below the previous breakout level of 1212.00 For the area, a savvy price action trader could have considered a short-term trade targeting a move to that level. Note: The 1212.00 or really 1215.00 – 1205.00 area was a very strong support zone due to the previous breakout. I expected a pull back into the area after an upward breakout.

In the following chart, we monitor how the market leaves levels when volatile and then levels of pullback to trade in line with existing momentum.

Notice the area marked “Watch out for pullbacks”. After the price breaks out of these levels, you should have watched the price pull back to these levels, go long, and trade along with the clearly developing bullish momentum. Ideally, we get price action signals at these levels after the price pulls back, but this is not always necessary. As I wrote earlier, sometimes all you need is the level of entry and the trend. See my girlfriend TLS. Article for more information…

Finally, we zoomed in on the latest price action on the daily gold chart.

From this chart, we can see some potential entry signals formed after the 1212.00 area and a pullback to 1237. Again, we had already marked these levels on the chart and were waiting to “attack” if price needed to move back to them. The price is trading just below the key resistance area around the 1305-1295 area.

Conclusion

I always think of analyzing the market from the “top down”. This means starting with the longest timeframe and zooming out, then progressively zooming in to shorter timeframes. We do this to get a “bird’s-eye” view of the market to see what’s been happening lately. Makes more sense in the long term context. Think of doing weekly and daily market analysis like reading a book. To understand what is happening on page 100, you must read and understand pages 1-99. Trading is exactly the same. You have to construct a narrative in your head from the market you are analyzing. To do this, look back in time, plot levels, analyze price action, catch up with the market at the close of each day, adjust levels or add to them. News if you want.

Once you do this regularly, it will start to become a price action trading routine and eventually a habit. In no time, you will thoroughly enjoy it. Because it’s fun to keep up with the market (if you’re a trading nerd like me anyway). So enjoy it. But also understand that what you are doing is aligning with the market and its price action. This is really what you need if you want the chance to learn to trade professionally.

Leave a comment below with your thoughts on this lesson…

If you have any questions, please contact us here.