Have you seen the Magic Eye posters that were popular in the 90’s where there was an image hidden within an image that required the eye to be properly aligned and a certain distance away from the image to see it? is there?

Have you seen the Magic Eye posters that were popular in the 90’s where there was an image hidden within an image that required the eye to be properly aligned and a certain distance away from the image to see it? is there?

I personally remember loving it as a kid and I’m not quite sure what happened, but these pictures popped into my head when I first started thinking about today’s lesson. That’s because markets, like these pictures, contain a ‘hidden’ message. This message can only be viewed correctly by those trained in the techniques and skills of price action trading. While the average person looking at a price chart sees a bunch of random bars that seem to mean nothing, price action traders know that money’s footsteps (price action) on the chart make them I see the message that it says.

This lesson explores the hidden messages in the market and how to make sense of them.

Listen to the market and hear what it says

To hear what the market is trying to tell you, you first need to know exactly what to ask. What you are hearing are clues to price action that will be left behind as the market “story” unfolds across the charts. Much like reading a book, understanding the current “page” requires knowing what happened before. In other words, you need to know how to analyze past price movements to understand current price movements. Use it to make educated predictions about what will happen next.

As you can see, a single bar by itself means nothing. It is the bar combined with the surrounding market structure or context that paints a picture of that market. Once you start following the market long enough, you start to get to know it and get a feel for it. This takes time, but it really is “listening to the market.”

Now, how exactly do you listen to the market and ‘listen’ to what it is trying to tell you? This is done through price action analysis. Here are some concrete examples…

Charts are the way the market “talks” to us, but if you don’t know what to ask, the message sticks in your head. Let’s take a look at some key pieces of the market’s price action language…

Recent price trends and market conditions

The first major message you need to learn to hear on the chart is whether the market is trending. If it’s trending, it’s very good for you. Because trend trading is the easiest way to make money in the market. not suitable for trading). This is important to learn to decipher early on. This is because it really determines the direction you are going to trade and what your overall approach to that market in that state should be.

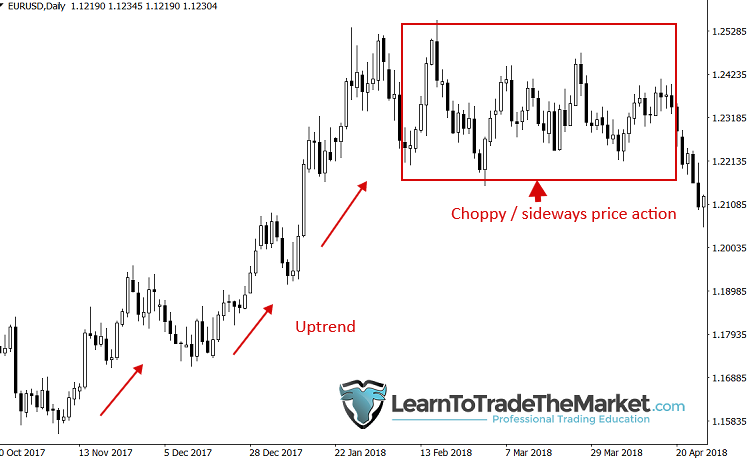

Notice in the chart below that the price has moved from a period of choppy/sideways (small range) price action to a strong breakout. The uptrend then took hold and the price pulled back to the midpoint of the trading range before rising for a few months…

In this image, the price was in an aggressive upward trend before pausing to enter a long-term sideways price action. Clearly, trend periods have been much easier and more fruitful to trade. increase).

Key Levels and ‘Perfect’ vs ‘Incomplete’ Technical Analysis

Perhaps the next most important ‘message’ the market can send you is how price is reacting/behaving at key chart levels. Very well respected (often nearly or even exactly). Sometimes not so much. I prefer to trade markets that respect important levels. Once you have identified these levels you can wait for high probability price action signals to form at those levels. However, if the price does not adequately reflect the level, it is better to avoid that market for now.

How the price reacts at obvious critical levels is very important. Are we technically “perfect” at this point, or is the technology more cumbersome and imperfect?

False break of key level and contrarian signal

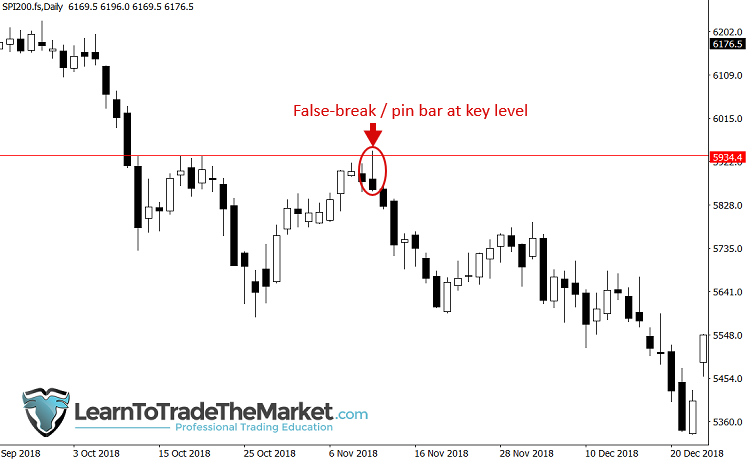

Human nature and brain wiring make most people really, really bad traders. When you look at the chart and see it going up, it feels like it’s going to keep going up, but usually this is the time to go down again (laughs). It can be very frustrating for beginners and traders who have not yet figured out how to hear and hear what price movements are telling us. But it means you have to trade like a contrarian to make money in the market. There are price action cues that hint when a contrarian move is underway and the price is about to head in the opposite direction. One of them is the level false break and of course the fake trading strategy. These are some of my favorite trading patterns because they show underlying market psychology and are powerful clues as to what might happen next.

Note in the chart below that the price accidentally breached the resistance before flipping low again in an aggressive fashion.

Failed price action signals are great. Wait what?

Ah, failed price action signals, yes they can be painful and can actually make trades go bad. This is a trading fact that must be addressed through proper risk management. But sometimes (you knew it was coming) a failed price action signal can be a very strong signal in itself. If the price violates the low, ask yourself what that indicates. What is the market trying to tell???

Don’t overthink it. If the price action signal fails, it is a strong cue that price may continue to move in the same direction…

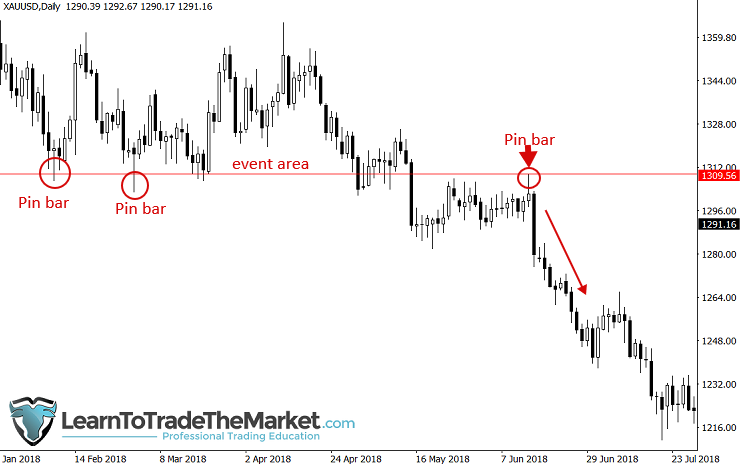

Event areas and recent profitable price action signals

If you don’t know what an event area is, I recommend reading my lessons on the topic. Because the event area is a very important message area that the market wants to pay attention to. If you see multiple price action signals originating from the same or similar area, you may have an event area, and if you see another signal in that area, it’s a very strong signal to consider .

Notice the pin bar on this level. If you didn’t know how to interpret the message the market was giving you when the final pin bar on the right formed, you missed out on a very profitable move…

Think beyond the actual trading activity

Technical analysis is a language that must be interpreted for any chance of success in long-term and sustained trading.

As most wealthy businessmen say. Listen well, listen to others, gather feedback, and make decisions. It is often said that you should be the last person to speak in your room. Most business he is a book cliché on leadership, but this happens to be true. Translated to the world of trading, it means “listening” to the market’s message, letting the market show you what it wants to do, and using the feedback you collect to form an opinion, plan, and act accordingly. can.

But it’s not just about “listening to messages”, it’s about combining the messages the market is sending (see example above) and formulating those messages into a “story” that is told on the chart from left to right. is needed. As we do in our weekly market commentary, you will want to annotate your charts with technical factors to create a visual “map”.

We use messages to make trades, avoid trades, and develop a general sense of market conditions, much like we read the weather and make predictions. You won’t act on every prediction you make, but some of them can be very helpful in planning what to do next.

In that sense, we should act on the clearest message and only on the strongest market predictions. The messages we interpret are not what I usually teach as the confluence of factors. The concept of “listening to the market’s message” goes beyond just finding trade setups. We are talking about listening to the messages the market is telling us about smart money. You can use that information to decipher a lot of things. I take action. So that when you reach a certain point of price action proficiency, it feels like the market is actually “talking to you” and telling you what to do instead of trying to tell you what to do. (which doesn’t really work).

Conclusion

My trading approach is based on looking at the charts daily and interpreting the messages being broadcast by the market. We are there, we have to listen to it, map it, and interpret it. Think of it like reading one page of a book every day. In the world of trading, we hear messages broadcast daily at New York closes, Monday through Friday (reading price movements, mapping charts, deciphering their hidden messages). But that doesn’t mean I’m sitting there staring at charts all day.Don’t force something that isn’t there to sit

9 times out of 10 it doesn’t take action, but 1 out of 10 it does The setup that pulls the trigger is noted. If you want to learn how to listen to the market and interpret it effectively, check out my Professional Trading Courses to learn more.

Leave a comment below with your thoughts on this lesson…

If you have any questions, please contact us here.