2023 Charles Schwab Modern Wealth Survey It highlights many contradictions about American wealth. Over 1,000 of his people of various backgrounds responded to the survey.

Overall, the study will run from March 1 to March 23, 2023 and states that a net worth of $2.2 million is required to be considered wealthy in 2023. The net worth is the same as in 2022, but up from $1.9 million in 2021. .

If there’s one good thing a bear market does, it’s lower asset expectations.

In this post, I would like to take a closer look at the data and point out the wealth paradox. Americans don’t seem to understand what it means to be wealthy. Also, we don’t seem to act according to our financial goals or personal beliefs.

Wealth Paradox #1: Inflation isn’t as bad as it looks

The first paradox of wealth is Americans’ inability to accept reality. Americans believe that inflation has a big negative impact on their quality of life.

The Fed has been aggressively raising interest rates since 2022 because of high inflation. But even as inflation hits a 40-year high, the amount of net worth you need to feel wealthy hasn’t increased.

With inflation rising 4% to 6.4% year-over-year in 2023, it’s natural to assume that the net worth needed to be wealthy in 2023 will also increase by 4% to 6.4%. In that case, his net worth in 2023 should range between $2.288 million and $2.34 million. But paradoxically, his net worth remained flat.

So the threat of inflation to American life may be exaggerated. Just as life goes on whether you act or not, inflation goes on whether you accumulate more wealth or not.

Wealth Paradox #2: Feeling rich when you don’t have enough

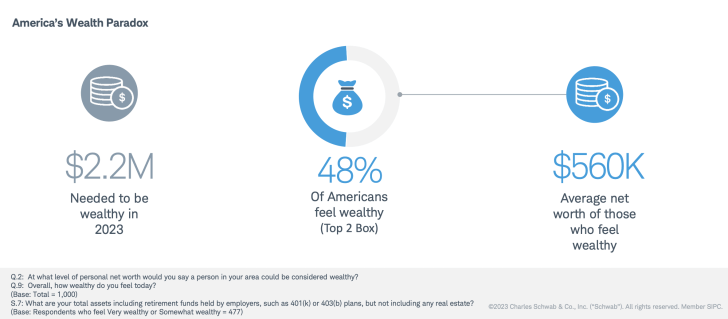

Although 48% of Schwab wealth survey respondents feel wealthy, the average net worth of those who feel wealthy is only $560,000. However, the net worth that survey respondents consider wealthy was found to be $2.2 million. The $1.64 million shortfall is huge, especially in terms of percentages.

So respondents are either lying about how much money they need to feel wealthy, lying about their net worth, or are inexperienced about how much they really need to feel wealthy. . Or maybe Americans are just delusional about money.

A personal finance writer since 2009, I believe most people overestimate their needs due to fear and uncertainty. At the same time, most people underestimate how much wealth can be achieved over time through consistency and compound interest.

You never know how much money you really need until you actually put yourself in the situation. It’s also hard to know how you’ll feel when you reach your target net worth.

Because there is a difference between imagination and reality, I try to write all my articles about financial samurai based on first-hand experience.

Wealth paradox #3: generational wealth

Another paradox is that millennials feel they are the wealthiest of the four major generations. Yet the mass media consistently millennial rags Because they are the unhappiest, loneliest, and poorest generation.

Millennials (defined as those born between 1981 and 1996) make up nearly a quarter of the population, but own just 3% of the country’s wealth, according to the Federal Reserve. not Survey on consumer finance.

The survey found that 57% of millennials feel wealthy compared to just 40% of boomers. But in another wealth paradox, the Boomers are actually the richest generation in history, given that they have saved and invested during the longest bull market in history.

Below is one of many charts showing the share of U.S. household wealth by generation. Baby Boomers dominate the amount of wealth in America, followed by Gen X, Millennials and Gen Z.

Why do millennials feel the richest and boomers the least?

So why do many millennials feel they are wealthier than other generations? That’s it. They grew up with the internet and know how lucky they are compared to billions of people who grew up without the same privileges.

Millennials are also at the height of their income and health. Because they have career-high incomes, they most want to accumulate more assets than they did in their 20s. And because they are still healthy, they can enjoy their wealth and feel physically good at the same time.

As for why baby boomers feel the least wealthy, I think the answer is that time is more valuable than money. We feel the least wealthy when we have the least time left in our lives compared to other generations. Baby boomers also have more health problems and regret what they could or should have done when they were younger.

But to add to the wealth paradox, research shows that people tend to be happier as they get older. In fact, I’ve argued that greater happiness is the number one reason for early retirement.

Wealth Means Having More Money Than Time: No Contradictions Here

Even without looking at the question of time and money, it turns out that most Americans feel that having time is more important than money. I’ve felt this way since I was 13 when my 15-year-old friend died in a car accident.

As you can see from the graph, Baby Boomers are the most likely member to believe that time is more valuable than money, at 67%.

Curiously, millennials, though not the youngest in the survey, were the least likely to believe time was more valuable than money, at 56%. I do not know why.

The stronger we believe that time is more valuable than money, the more willing we are to save and invest for the future. It also increases your willingness to retire early or find a rewarding job.

I quit my job at 34 and still haven’t returned because of my strong belief in the value of time. So far, I have yet to find a full-time job worth more than my freedom.

I am a firm believer in the value of time, did not do it I find it difficult to regularly save more than 50% of my after-tax income for more than 10 years. For me, the reward of buying back future time was well worth it.

someone who believes that money is more valuable than time

Even though 61% of all generations believe time is more valuable than money, 39% still believe money is more valuable than time. To me, 39% is a surprisingly high percentage. Because we can always make more money, but we can never make more time. I think the percentage split should be closer to 80% / 20%.

But I also understand why the majority of people in wealth surveys say money is more valuable than time. First, because this study focuses on money, there may be an invisible hand of persuasion. But more importantly, if you feel like you don’t have enough money, over time you will become a more logical choice.

Describing wealth reveals more contradictions

The final paradox of wealth is how survey participants described what wealth meant to them.

- 72% of participants believe a fulfilling personal life and a healthy work-life balance are the most important aspects of wealth, yet Americans are the most overworked in the world. Americans work the most hours per week and take the fewest annual vacations.

- 70% of participants believe that not stressing about money is more important than having more money than most people you know. But the median long-term savings rate in America is only 5%. If Americans really believed wealth was not having to stress about money, they would save a greater percentage of their income.

- If 63% of survey participants believe that being healthy is more important than being successful, why aren’t Americans eating better and exercising more? highest.

- If 64% of survey participants believe they should now pay for family experiences rather than leaving a legacy, why is over $50 trillion worth of wealth being transferred from the oldest generation? are you there?

Not Acting on Beliefs: The Greatest Contradiction

It is clear that many Americans are not acting in accordance with their economic convictions. As a result, many Americans suffer dissatisfaction, regret, and unhappiness as they age.

Readers and listeners of Financial Samurai, please. act according to one’s own ideas.Don’t be the kind of person who puts off starting a business, writing a book, traveling, breaking into another industry, or dating. sometimes. Because if you don’t take action, one day it tends not to come.

My Current Wealth Paradox

I am currently experiencing a wealth paradox. This is because even though you have saved more money than you need, it is difficult to withdraw by spending more money. Instead, I continue to save and invest at least 20% of my post-tax disposable income each year to support my family.

After 24 years out of college, I find it difficult to change my financial habits. I am always risk averse for the unknown future of bear markets, illness, theft, and accidents.

Now that we have a family of four and stabilize, we should be able to model more aggressive spending patterns. Later in life, I plan to break the wealth paradox by giving more, spending more, and investing less.

Part of the reason I keep writing so much about Financial Samurai, even though it takes time, is because I want to contribute more. I want to help more people find the financial courage to do more.

It takes two people to live in a married family

Another problem I have is that I would like to spend more money but face the challenge of getting my wife involved.

For example, I know the easiest way to save is to buy a more expensive house. When property taxes and maintenance costs go up, it’s easy to spend your property on a better home base.

But upgrading a home has proven difficult, so we continue to invest that extra money in stocks, bonds, and online real estate. Ten years from now, our investments will likely be even more valuable, which further exacerbates my wealth paradox.

In the same way that saving money requires intentional effort, spending money requires just as much intentionality. But if you consider that the method of least resistance is to do nothing, it is much easier to invest more and gain greater wealth.

Reader Questions and Suggestions

What wealth contradictions have you noticed in the United States or your country? What wealth contradictions have you identified in your own life? Why more people will not take action to get what they want?

If education is irreplaceable, why not buy my book Buy This, Not That for less than $20 after tax on Amazon? The most comprehensive, step-by-step personal finance book.

If wealth is important to you in providing more happiness and freedom, why not sign up for Empower’s free wealth management software? Why not sign up for a free net worth analysis with one of our advisors? A second opinion from an expert can be very helpful.

Want to learn more about finance? Join over 60,000 other users, sign up for the weekly Financial Samurai newsletter, and subscribe to my podcast on Apple or Spotify. They are all free.