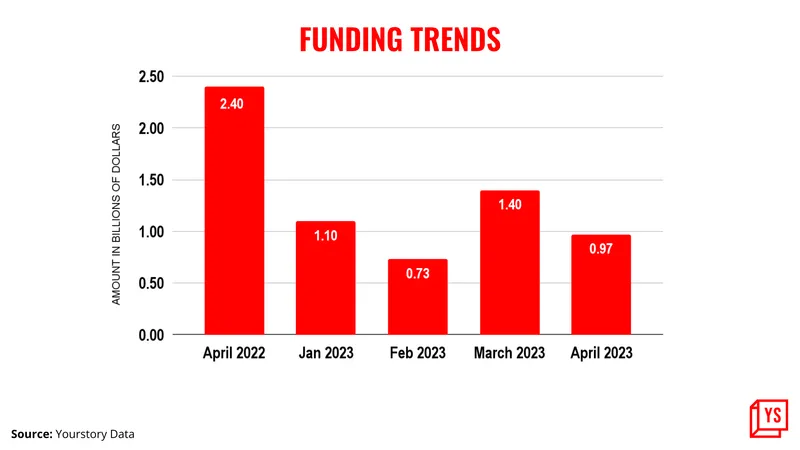

Venture capital (VC) funding for Indian start-ups fell by 60% in April. His second total capital inflow in 2023 saw him fall below the critical $1 billion mark on a monthly basis.

VC funding in April 2023 was $971 million, compared to $2.4 billion in April 2022. Funding volume decreased by 31% month-over-month when compared to March 2023.

This drop in VC funding highlights the challenges India’s startup ecosystem faces in raising capital and the cautiousness exhibited by investors. This environment is unlikely to change anytime soon.

However, PhonePe and DMI successfully raised over $100 million in funding in April. Aside from these two startups, no other startup raised this amount last month. Other high-value deals during this period ranged from $30 million to his $70 million.

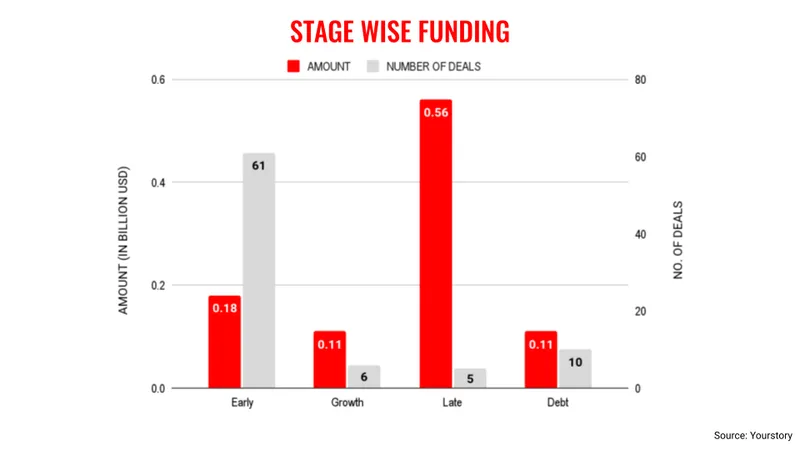

In terms of transactions per stage, the late-stage category topped the list at $566 million, spread across just five deals. However, the early-stage category saw the most activity, with 61 deals raising $181 million for him.

This has indeed been the trend ever since the slowdown in fundraising began, with investors primarily concentrating on the early stage category of startup investment. It’s getting less.

Fintech emerged as the major sector receiving the highest amount of funding in April, with $585 million, followed by hyperlocal at $81 million and logistics at $53 million.

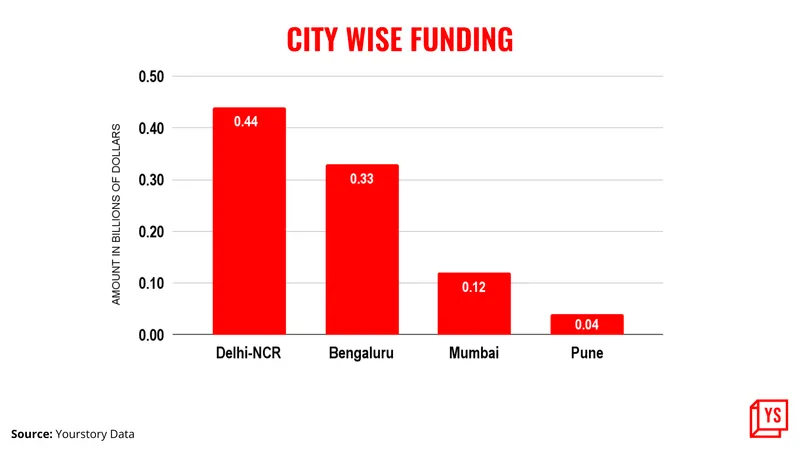

In terms of cities receiving the largest share of venture capital, Delhi NCR again topped the list with $442 million, followed by Bangalore with $339 million and Mumbai with $123 million.

There were also 12 mergers and acquisitions (M&As) in the same month, across segments such as edtech and fintech.

Totals exceeded $1 billion in January and March and fell below this level in February and April.

It is not certain when the influx of VC to venture companies will steadily increase. Industry observers think it’s unlikely that it will happen this year. He is only in 2024 to see strong activity.