Data show that Bitcoin has been trading in a historically tight 14-day range recently, with big moves in the past.

Bitcoin’s 14-day Range Has Been Very Narrow Lately

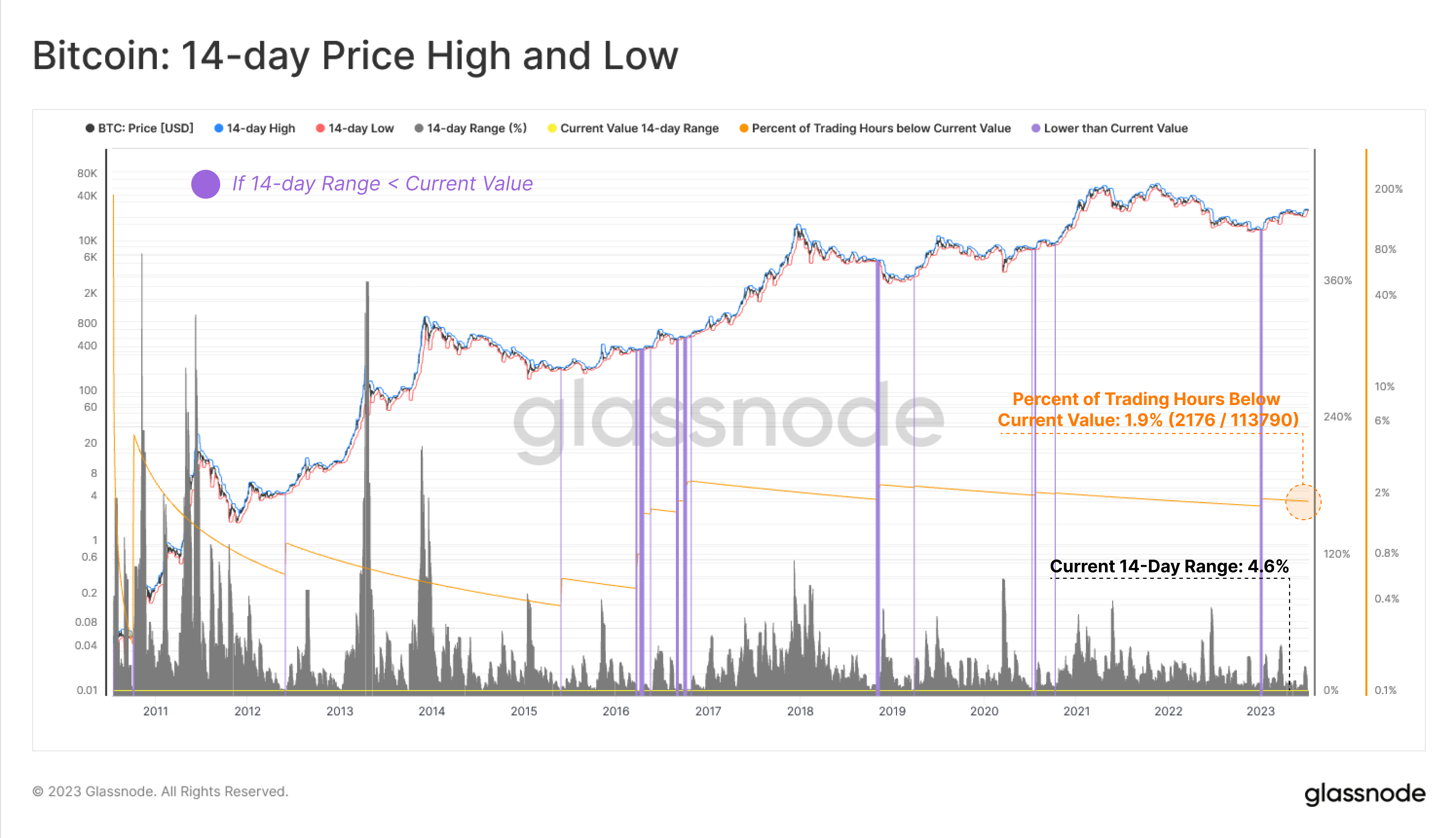

According to data from an analytics company glass node, the 14-day range was only narrower than it is today, with less than 2% of the total cryptocurrency trading period. The ’14-day range’ here refers to the percentage difference between the highest and lowest recorded values in the Bitcoin price over the past two weeks.

This indicator allows us to know the degree of recent fluctuations in asset prices. If its value is high, it means that the coin has observed large fluctuations in the last 14 days and has high price volatility.

On the other hand, if the value of this indicator is low, it means that the cryptocurrency is not very volatile as the price has changed only at a low rate over the past few weeks.

Here is a chart showing the trend of Bitcoin’s 14-day range over the history of the asset.

Looks like the value of the metric has been quite low in recent days | Source: Glassnode on Twitter

As highlighted in the chart above, Bitcoin’s 14-day range is currently just 4.6%. This means that the difference between local highs and lows over the past two weeks is only 4.6%.

This is a very low value when compared to the common standard for BTC. On the chart, Glassnode also marked instances where the indicator observed even lower values than the current one.

As you can see from the purple bars, it is extremely rare for Bitcoin to trade within a narrow range. In terms of numbers, only 2,176 hours in the lifetime of an asset recorded a lower value for this metric, equivalent to about 1.9% of the total trading life of the oldest cryptocurrencies.

Historically, every time the indicator hit such a low value in the 14-day range, an interesting pattern followed. From the graph, we can see that Bitcoin has typically been wildly successful during this period of very low volatility.

This violent move could go in either direction, as both the crash and the rebound are continuing within a narrow range. Oddly enough, however, most of these movements are upward.

The last time this pattern occurred dates back to January, just before the current bull market first started. At that time, it seems that the narrow range has exploded.

Historically, the current low 14-day range may mean that more sharp moves in Bitcoin are possible in the near future. And unsurprisingly, given priorities, such a move is more likely to be upward.

BTC price

At the time of writing, Bitcoin is trading around $30,900, up 1% over the past week.

BTC appears to be surging | Source: BTCUSD on TradingView

Featured image of André François McKenzie on Unsplash.com, charts on TradingView.com and Glassnode.com