The Nasdaq is about to do something it has never done before…

Deweighting the top six stocks in the widely supported Nasdaq 100 index.

I’m sure the stock on the cutting board looks familiar…

- Apple (AAPL)

- Microsoft (MSFT)

- NVIDIA (NVDA)

- Amazon.com (AMZN)

- Tesla (TSLA)

- Alphabet (GOOGL)

- It may also include the Meta Platform (META).

why? Because these six (or seven) stocks together make up about 50% of the Nasdaq 100…and he was so focused on breaking the Nasdaq rules on July 3rd. I was.

It’s unclear at this time how much each stock will receive a reduction…but the Nasdaq plans to publish the new weights after the close of trading today and implement the changes before trading opens on Monday, July 24.

Details aside, one thing is certain: there will be forced sale You can fully feel the impact of these stocks…and your portfolio.

We don’t call the creative license “mandatory”.will really be forced sale of the above names. It’s just stock market indices and the mutual funds and exchange-traded funds (ETFs) that track them.

If an index provider (in this case Nasdaq) determines that the Nasdaq 100 Index should retain a 12% allocation to Microsoft (MSFT) stock…the ETF provider that has promised investors to track the index ( QQQ, etc.) Must 12% of the funds will be invested in Microsoft stock.

A day later, when the index adjusts the MSFT weight to 10%… ETF Providers Must To reduce the position size, sell stocks Valuation of MSFT in the open market.

Well, here’s a “just a fact, ma’am” explanation of what to expect from the Nasdaq special rebalancing.

The important thing to consider is what this means for you.

Will a tech giant split change anything?

Please understand that this event does not mean the end of “Big Tech” stocks.

The U.S. Department of Justice’s Antitrust Division did not issue an order to break up Apple or force Alphabet to sell its business units.

And judging by Microsoft’s victory over the FTC in trying to block its nearly $70 billion acquisition of Activision Blizzard, its attempts to “crack down” on Big Tech haven’t gone so well.

Regulators have proven ineffective in keeping America’s biggest companies from getting bigger and bigger. but, perhapsthe “market” will do the job…?

You see, momentum works both ways. Virtuous Cycle of Investor Demand That Pushed NVDA, AMZN, GOOGL To Over $1 Trillion Market Cap… AAPL & MSFT Above 2 trillion dollars Market caps…and each of them can work against index stocks…inversely.

On the way up, investors bought big tech stocks … which pushed the stocks higher … then increased their weight in “capitalization-weighted” indices such as the Nasdaq 100, and so on.

This has made indexes, especially big tech stocks, perform better… but has created concentration issues.

Many people think that when they buy a market capitalization weighted index such as the Nasdaq 100 or the S&P 500, they are buying the market “passively”.

In fact, they can be rightly called “momentum investors”, as the stocks exhibiting the strongest price momentum are making up more and more of the index.

Again, the virtuous cycle big tech stocks have enjoyed since the middle of the last bull market can run backwards.Declining investor demand will lead to lower buying activity, boosting big tech stocks under …then Descent Market cap weighted index shares.

We’ve seen a bit of this in 2022 as big tech stocks have taken the brunt of the damage, pushing the overall market down.

In other words, stocks can go through both virtuous (positive) and vicious (negative) cycles in a market cap-weighted index.

And frankly, they depend on: investor psychology.

As long as current and future GOOGL shareholders believe so, of GOOGL’s stock will trade higher, expand its market capitalization, and eat away at ever-larger shares of indices, mutual funds, and ETFs.

If some GOOGL shareholders lose faith in the company and start to feel that the stock is too valuable, or simply find more attractive uses for their money on GOOGL, the stock will trade. . lowwhose market capitalization is Shrink And they will make up smaller and smaller shares of indices and funds.

Please understand that this can happen even if Alphabet continues to dominate its respective businesses and generate huge operating profits. That alone does not necessarily mean that the stock price will rise further.

So…

What should I do about it?

Investor sentiment is notoriously fickle and difficult to predict.

The term ‘irrational frenzy’ coined by former Federal Reserve Chairman Alan Greenspan in 1996 could endure far Longer than any sober skeptic would expect.

So there’s no doubt that the investor sentiment that has pushed the Nasdaq 100’s major stocks up significantly may actually continue for months or even years. It could also turn on 10 cents.

Standing in front of the Shinkansen, the market-leading bull market for big tech, is risky. At the same time, if we didn’t at least consider the risks of such a highly concentrated climb, we would be like an ostrich with its head in the sand.

in the market I never have Like today, it was concentrated in a few mega-cap stocks. Even at the height of the 2000 dot-com bubble, the top 10 stocks of the Wilshire 5000 Index accounted for his 20.3% of the market. The top 10 stocks now account for almost 26% of the total market.

I wrote about this just a month ago when the “AI fever” was at its peak.

And whether or not you believe a highly concentrated Nasdaq is a sign of trouble for the stock market as a whole, it would be wise to at least consider options for building a more diversified stock portfolio.

One option is to invest in an equal weight index fund rather than a cap weight fund.

An equal weight fund invests roughly the same amount of capital in each stock it owns. This not only reduces the net influence of the largest stocks in the fund, but also increases the influence of small-cap stocks.

For example, if you want to invest in a broadly diversified basket of technology stocks… SPDR S&P Software & Services ETF (NYSE: XSW) Instead of SPDR Technology Sector ETF (NYSE:XLK).

XSW uses a modified equal weight portfolio construction methodology, investing approximately equal amounts in each of its 150 software and IT services stocks.

XLK, on the other hand, uses a modified capweight method. We own about half of XSW, but 45% of our assets are just concentrated in XSW. two Stocks — Apple (AAPL) at 23.1% and Microsoft (MSFT) at 22.5%.

Otherwise in my 10x stock I’m building a portfolio of stocks that have the potential to return 10x or more in the course of a bull market.

I started building my portfolio in June of last year and have already seen returns in excess of 100% on many positions, with some currently rising above 200%.

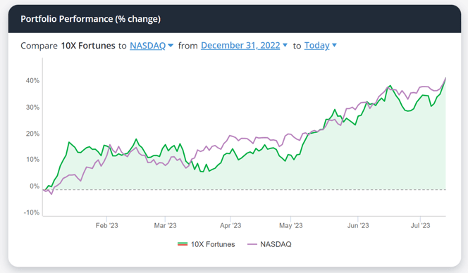

Our core model portfolio is in line with the market-leading NASDAQ 100 this year. And the portfolio is more diverse than the Nasdaq 100, according to the TradeSmith software we use to manage it. Outliers we recommend in pharmaceuticals and energy continue to perform well, as do tech stocks.

Many of these stocks trade at less than $5 a share, unlike the eye-popping stock prices of big tech companies. (And hedge funds are struggling to break above $5– Learn why here. )

Only time will tell if the first special rebalance in Nasdaq history will be a turning point for Big Tech or a “nothing burger”…

A special Nasdaq rebalancing would mitigate the future impact of big tech on index returns, but it cannot retroactively undo the highly concentrated nature of this year’s rally.

Either way, as a knowledgeable investor, you should know what you’re buying.

If you’re buying the Nasdaq 100 thinking it’s “diversified” across 100 individual stocks…in reality, most of your profits are, for better or worse, less than my finger. It is brought about by the brand.

It’s great on the way up, but can hurt like hell on the way down.

As I said earlier, if you’re looking for a more diversified exposure to technology or other markets, consider an equal-weighted ETF. Even better, check out the advanced features. Diversified Portfolio under construction 10x stock As a low-risk alternative to the Nasdaq 100.

to get a good profit

Adam Odell

Adam Odell

Chief Investment Strategist, money and market