The Fed introduced another rate hike on March 22nd, but a new round of banking crises dominated the headlines.

In the face of these broader economic headwinds, our data from the US and Canada show that hiring activity in SMBs is down month-over-month.

Another rate hike by the Federal Reserve in March has left many worried about a persistently hot economy and the effectiveness of leaders’ efforts to curb inflation. Similar to previous iterations of this report, Homebase has analyzed behavioral data from over 2 million employees working in over 100,000 SMBs to predict that the broader economic environment will be more competitive for SMBs in early 2023. and its employees.

Summary of findings: Core activity markers have flattened to declining from mid-February levels, with the downward trend accelerating through the end of March.

- The once-hot economy is showing signs of slowing down. Core indicators show none of the seasonal growth we have seen in the last few years.

- Hospitality and entertainment diverged from other industries with increased activity in March – Leisure industry activity generally outperforms the downtrend, driven by Spring Break.

- metropolitan area average little or no economic growth From February to March.

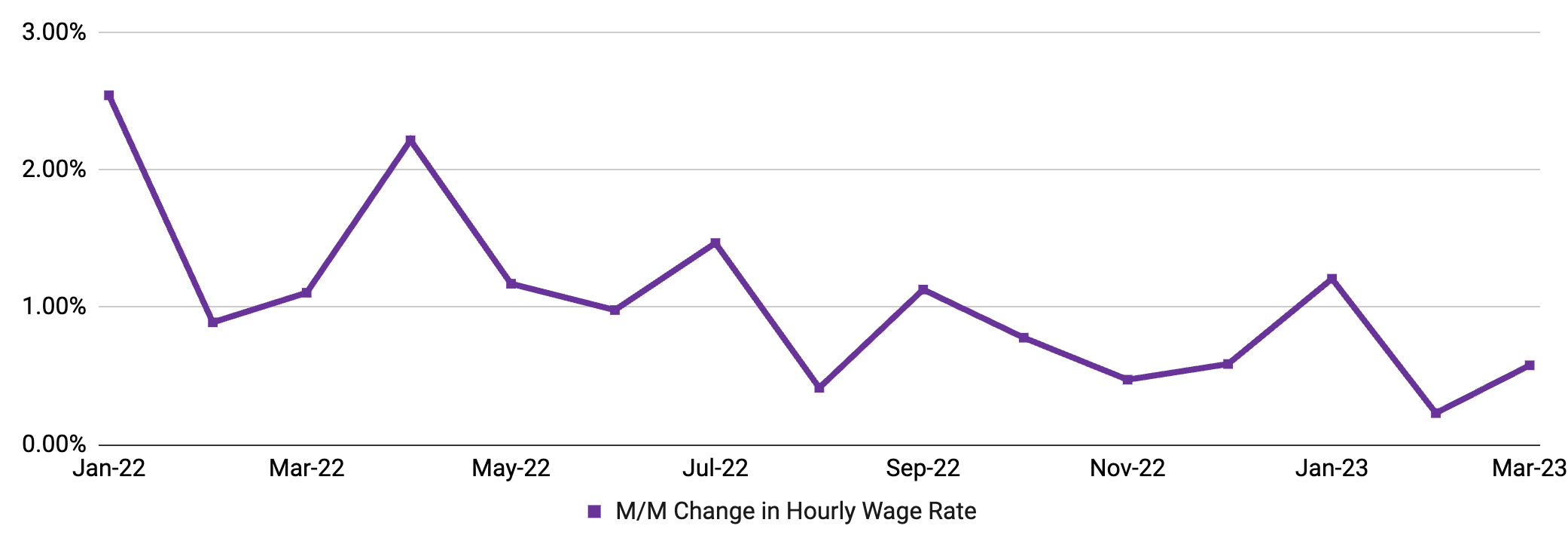

- Wage inflation rose 0.58% in Marchconsistent with the modest growth seen at the end of 2022.

Economic activity on Main Street shows signs of slowing down

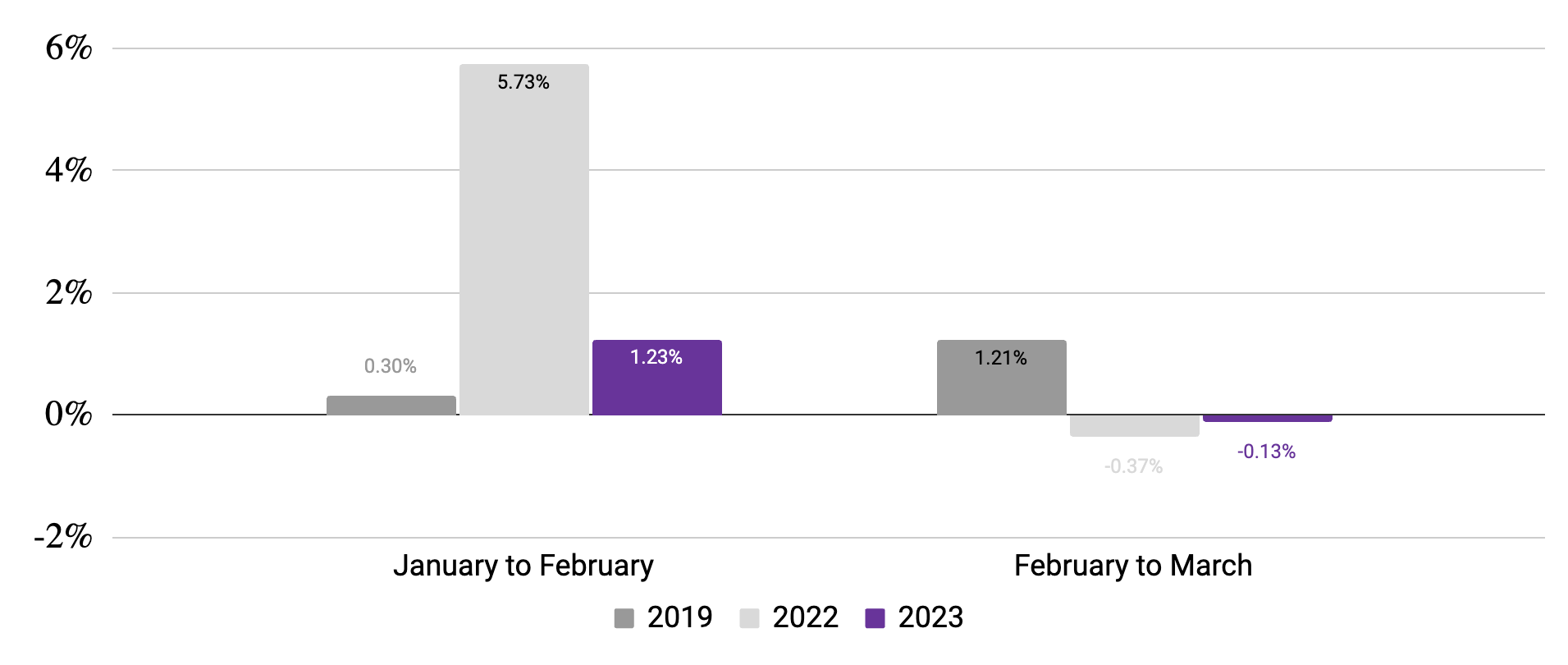

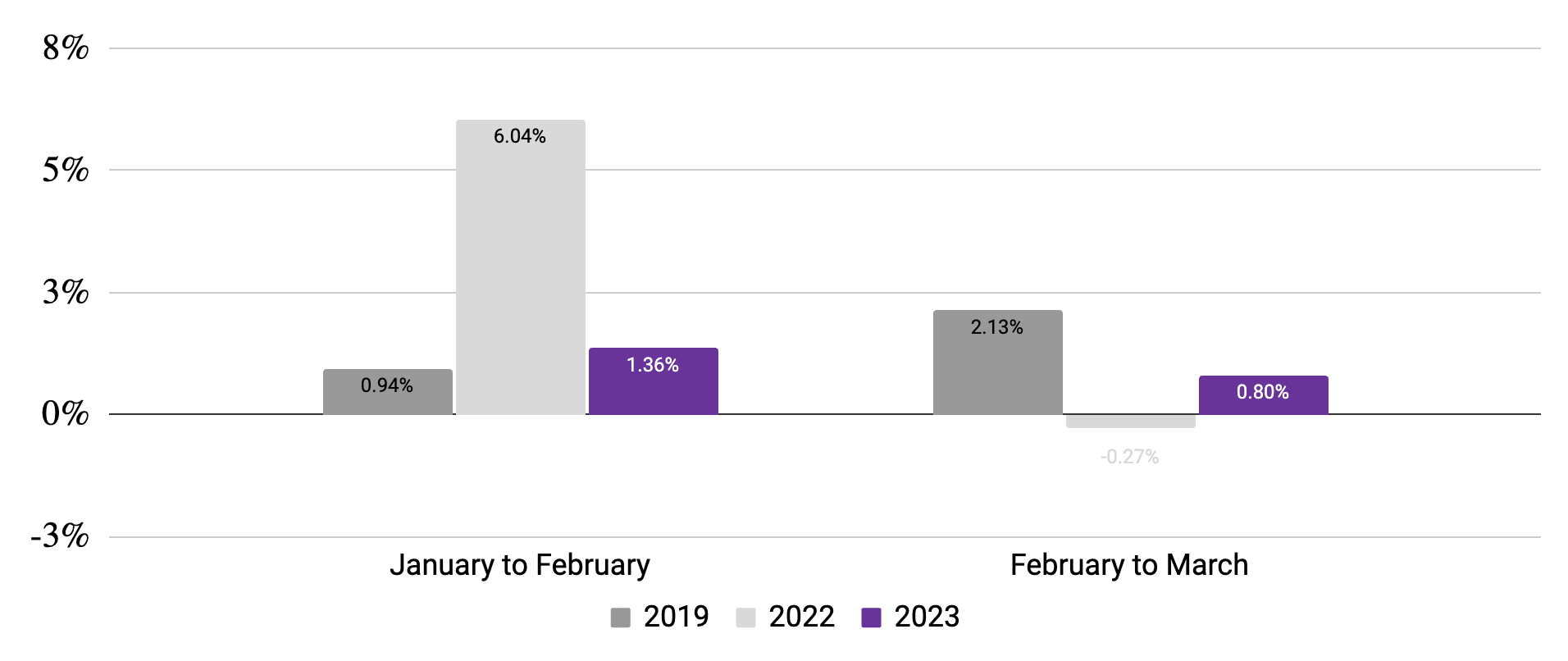

After a strong start to 2018, both headcount and hours have shown downward trends over the past month. This goes against the usual seasonal pattern.

working employee

(7-day average monthly change compared to January of the reported year)

working time

(7-day average monthly change compared to January of the reported year)

Source: Headquarters data.

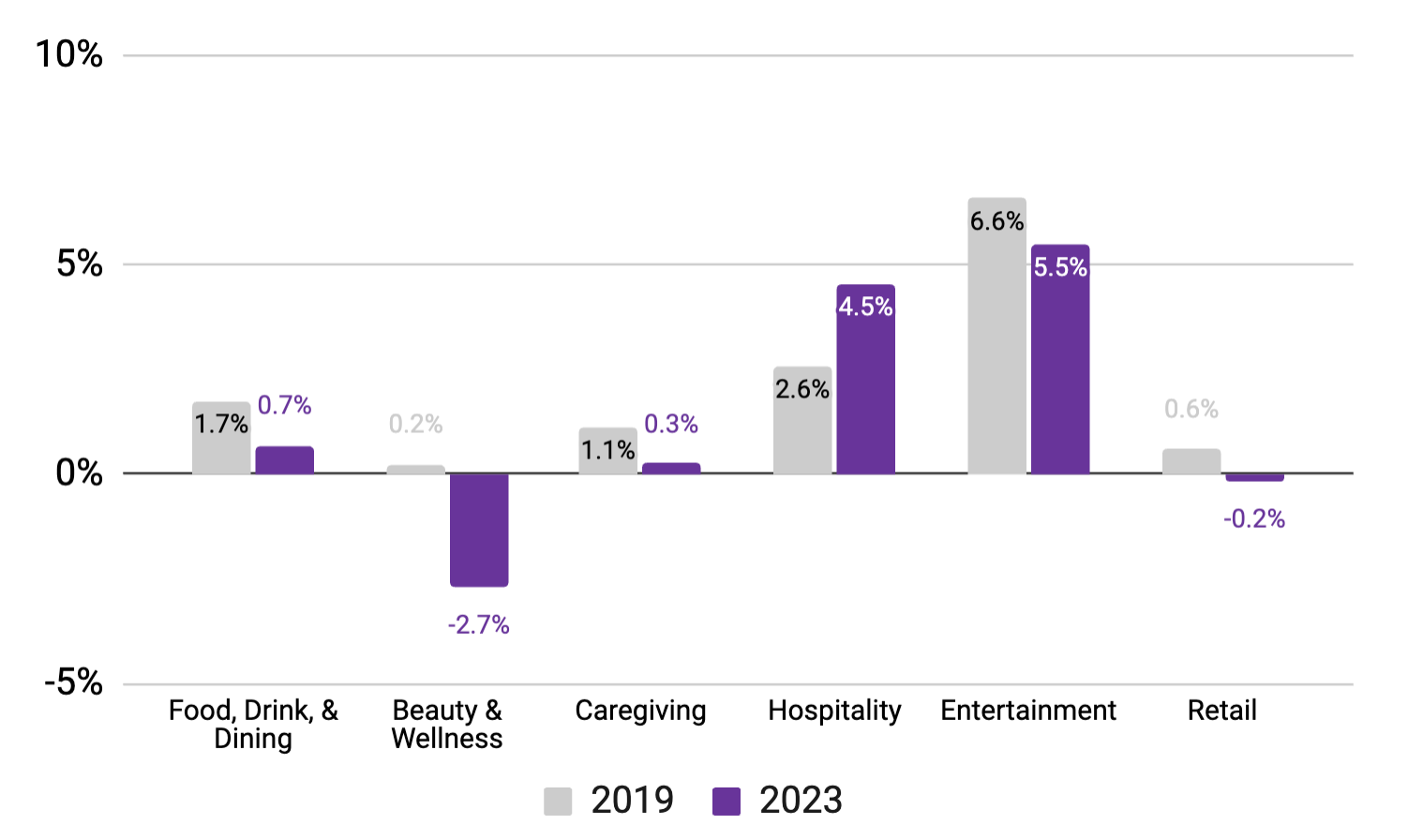

Hospitality and entertainment continue to be bright spots for growth as activity in other industries declines

Both hospitality and entertainment have seen a significant increase in the number of employees working in the past month (4.5% and 5.5%, respectively), Spring Break entertainment growth in March was no more significant than pre-COVID.

Beauty & Wellness showed the biggest decline It fell about 3% from February to March, while other industries remained relatively flat.

Rate of change in working employees

(using baselines of mid-February and mid-January, January 1919 and January 23)1

1. March 10-16 vs. February 10-16 (2019) and March 12-18 vs. February 12-18 (2023). Notable dips usually coincide with major US holidays.Source: Headquarters data

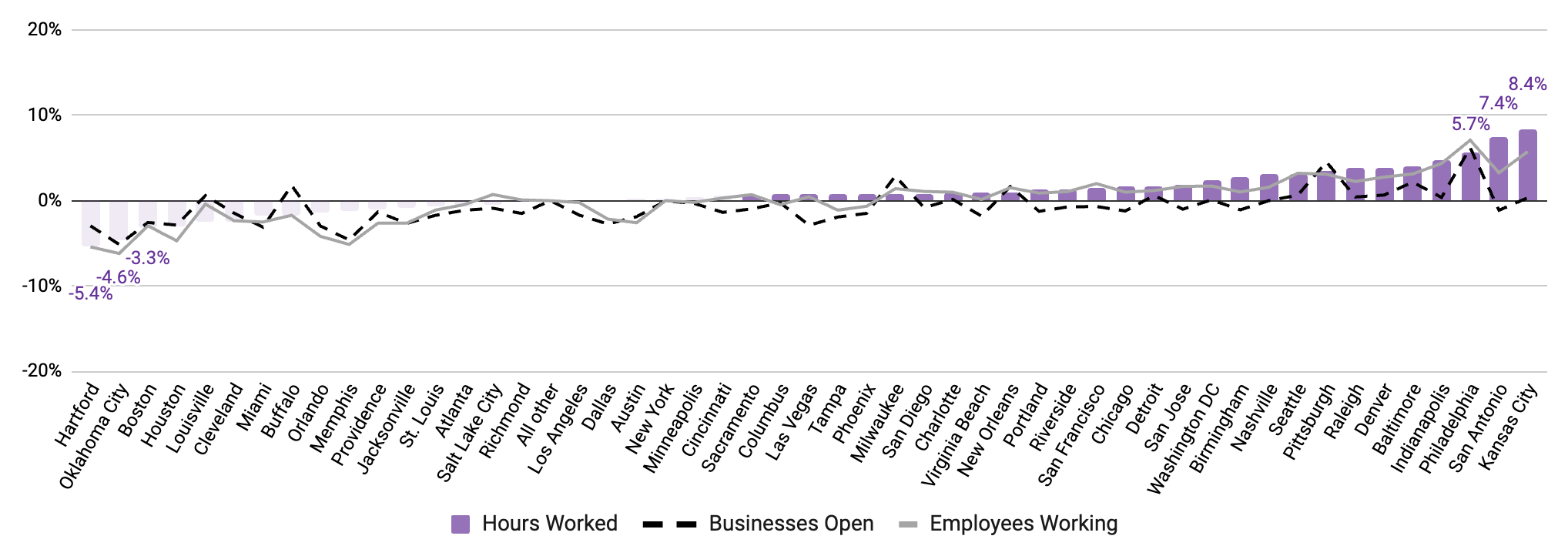

Employment activity has barely grown in the average metropolitan area

Note: March 12-18 and February 12-18.Source: Headquarters data

Wage inflation rose again in March, below the modest growth seen at the end of 2022 and the 2022 average

wage inflation

Month-to-month change in average hourly wage

For a PDF of the March report, please visit this PDF. Please cite Homebase if you use this data for research or reporting purposes.

March 2023 Home Base Main Street Health Report