Andrew Jackson said, “One man with courage makes up the majority.”

All my life I’ve seen the impact of one person.

Especially when it comes to leading a company.

Wall Street believes CEOs are like light bulbs and are interchangeable.

That’s not how I saw it.

In fact, many investors can’t even name the CEO of their largest holding!

It always thought me a little crazy.

It’s hard not to look at the people who run the business, set the strategy, and allocate the capital.

especially that person maximum Impact on stock returns.

Partnering with a great CEO rarely goes unprofitable in the long run.

That’s why I was drawn to Uber Technologies Inc. (NYSE: UBER) when Dara Khosrowshahi took over as CEO in 2017.

At that time, Uber was already the world’s leading ride-sharing app.

But business was out of control.

The #DeleteUber movement has killed 200,000 passengers…

Former engineer Susan Fowler wrote a bombshell blog denouncing the company’s culture…

And lawsuits flooded in, forcing the former CEO to step down before a new leader could be appointed.

And that’s when Khosrowshahi became CEO and started cleaning the house.

Despite being dismal, Uber’s business slowly turned around.

Thanks in large part to him…

supercharged CEO

Prior to joining Uber, Dara Khosrowshahi was CEO of Expedia since August 2005. Under his leadership, bookings have more than quadrupled and revenue has more than doubled.

Expedia’s stock soared more than 600%, nearly quadrupling the S&P 500 during Khosrowshahi’s time as CEO.

The hallmark of great CEOs is their ability to replicate their successes in other industries.

And that’s exactly what he did.

Since becoming CEO of Uber, he has transformed the company’s culture, optimized operations and focused on generating free cash flow.

Unlike its main competitor, Lyft Inc. (Nasdaq: LYFT), Uber does more than just offer ridesharing. They also have UberEats, contactless delivery for restaurant takeout.

UberEats gives drivers two ways to make money. UberEats can deliver when your rideshare business is slow.

This is a big factor in attracting new drivers to the company.

It also helped increase Uber’s share of ridesharing from 62% in early 2020 to 74%.

Meanwhile, Lyft’s market share fell from 38% to 26%.

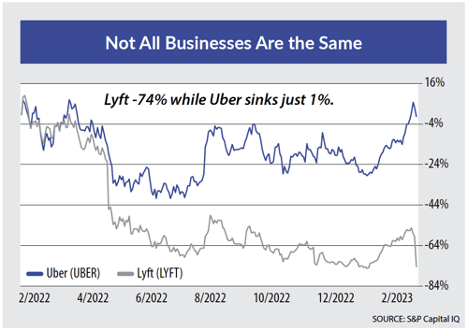

The company’s performance further reinforces the claim that not all companies in an industry are the same.

In February, both Uber and Lyft reported earnings every few days.

Uber finished its best quarter ever and closed out its best year.

Lyft reported a few days later … falling revenue, lower guidance, and flat rideshare growth.

The share prices of both companies speak for their business performance over the past year.

Obvious difference

Uber and Lyft hold most of the market share in the ridesharing industry.

Still, one of them has three times the market share of its competitors and is profitable, while the other is pretty close to life support.

and the maximum The difference between them is the person in charge.

Lyft has always been run by founders Logan Green and John Zimmer. Both were tech dreamers and had great success with rideshare apps.

But when it came to running the business, it just wasn’t viable.

Meanwhile, Khosrowshahi has led Uber from the front lines for the past six years.

Last September, Uber was slowing driver hiring.

So Khosrowshahi went from behind the desk to the front seat of a used Tesla.

He secretly worked as a driver as “David K.” and received about 100 fares.

He wanted to fully understand the driver’s experience first hand.

Khosrowshahi found the driver complaint valid and is currently working on the issue.

The Lyft founders have announced that they are stepping down as president and CEO after years of making grand promises about their future.

Meanwhile, Khosrowshahi remains focused on increasing shareholder value and building the best possible business.

or who you want to do business with.

Partnering with Winners

Good leadership gives companies great advantages, regardless of what industry they belong to.

Rockstar CEOs like Khosrowshahi can guide their businesses through pandemic lockdowns and bear markets through good times and bad.

But they also have some responsibilities maximum Movement in the history of the market…

What starts as a single decision from one of these CEOs can evolve into a multi-billion dollar idea that transforms the market as we know it.

Just like when Steve Jobs decided that computing shouldn’t be technical and user-friendly, it released the first Apple computer to do just that.

Or when Henry Ford decided to double the workers’ wages so he could build his cars in the best possible condition.

These decisions may seem simple or even trivial at this point. However, in the long run, it can bring significant returns to shareholders.

So, dear readers, Next billion dollar move.

It involves a smart CEO making the right decisions at the right time. He could quickly transform a small company into a multi-billion dollar behemoth, potentially making investors rich.

Visit here to sign up and reserve your spot for this special presentation.

nice to meet you,

Charles Mizrahi

Founder, alpha bester

Charles Mizrahi is looking for a Rockstar CEO.

Well, few American CEOs fit that description like the late Sam Walton, founder of Walmart.

Through vision, a keen grasp of his market and a pure courage, Walton built the largest retail empire in history. And he did it with a logistical system arguably better than the world’s top militaries.

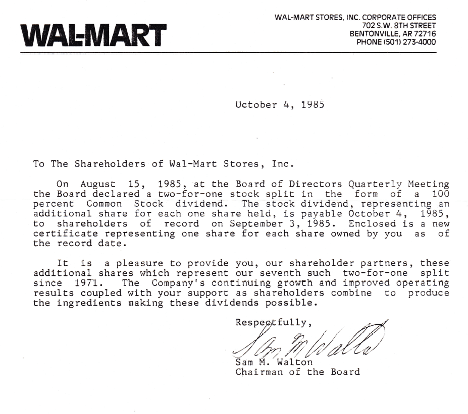

If you have read my work, you know that I learned a lot from my grandfather. Years ago I was digging up an old file cabinet that belonged to him. And then we found this little blast from the past: Walmart’s letter to shareholders signed by Walton in 1985.

As a kid in the 1980s, I remember my grandfather proudly showing me a paper deed of Walmart stock.

I also remember the day he went electronic — by handing paper certificates to the bank’s trust department. He wasn’t sure he trusted the system, and he always made a copy of the certificate before handing it over, just in case.

Paper stock certificates look very outdated in today’s age of online trading. I wonder how the investment world will change when my future grandchildren go through my personal belongings drawer.

The truth is, we don’t know how beneficial instant liquidity is in building long-term wealth.In fact, it’s probably downright harmful. When my grandfather bought stock in Walmart in his 1970s, the high transaction costs discouraged him from flipping short-term stops.

As a result, my grandfather, whom I called “Papa,” became a de facto long-term investor. And his investment eventually paid off as Walmart grew into one of the largest and most successful companies in history.

It’s been a long time since my dad passed away, but the cash dividends he saved from his lifelong Walmart stock continued to pay for my grandmother’s retirement and even my college tuition!

If my grandfather had access to instant liquidity today, he might have been tempted to sell too quickly. But he took Peter Lynch’s advice and put it into practice. length Before Lynch became a household name: that is, invest in what you know.

Dad is an Arkansas boy, born and raised near Fort Smith. He liked to invest in local businesses that he could directly observe.

Walmart is one such local company. The company’s headquarters in Bentonville is about an hour’s drive from Fort Smith.

I fondly remember my grandfather taking me to Walmart in Fort Smith and buying me ice cream at the snack bar. He liked to walk down the aisles and see personally what Mr. Walton was doing with his money.

It may seem a little outdated today. But again, that’s the approach taken by Warren Buffett and many long-term value investors. If done right, it works.

When you find a gem of a company run by a Rockstar CEO who puts blood, sweat and tears into their business, sit back and let them do the work.

nice to meet you,

Charles SizemoreEditor-in-chief, The Banyan Edge

Charles SizemoreEditor-in-chief, The Banyan Edge

PS And if you want to know the ONE CEO of a company with a $5 stake that could change an investor’s life forever… Click here for attendance confirmation To Charles Mizrahi’s special (free) event: The next billion dollar move.