Competition exists in the market. When every decision comes down to a buy-or-sell dichotomy, winners tend to make sacrifices on losers.

But at first glance…there are no clear winners in this year’s banking crisis.

Silicon Valley Bank executives have indeed lost their company (worth $212 billion), their reputation, and perhaps a piece of their heart. That doesn’t include First Republic, Signature, or Credit Suisse… you get the idea.

The bank’s depositors lost temporary, albeit long-term, access to funds that would eventually be perfected by the FDIC. The loss was even worse for Silicon Valley Bank, which was catering to technology startups desperately in need of cash right now.

The FDIC also lost. It has exhausted $22 billion in recovery reserves and banks are now being assessed to replenish the fund. (That bank lost too…)

And when it comes to losses, investors are in much the same position as the executives of these failed banks.

Silicon Valley Bank’s stock fell from a high of $755 a share long before the bank’s collapse to $100 a share before it was delisted. This is him an 85% loss…and tens of billions of dollars in market cap completely destroyed.

First Republic went from bad to worse, losing more than 98% of its value at the same time… from nearly $40 billion to less than $1 billion in just over a year.

So if all of these actors lose, who is likely to win?

Trader, who is it?

A large amount of ink has been spilled why We are in a banking crisis.

That’s why I want to focus today on the few people who have actually benefited from this or past crises, and how they can do the same with far less risk than they once took.

One Man’s Trash…

In the turmoil of Silicon Valley Bank and Signature Bank failures this year, some shrewd short sellers were able to anticipate the risk and turn it into windfall profits.

Hedge funds had $7.25 billion in unrealized gains in March, according to financial analytics firm Ortex. That made it the most profitable month for short sellers since the 2008 financial crisis.

And when the First Republic collapsed earlier this month, short sellers took in another $1.2 billion.

In all these situations, one man’s trash quickly became another’s treasure.

For those unfamiliar, short sellers bet on stocks and make a profit when the stock price goes down.

Well, opportunities like this rarely come. Markets generally go up. Prolonged bear markets like the present are rare throughout history.

This is why short sellers pay attention to what is often said. special circumstances — A unique event where various factors overlap to form a ‘perfect storm’.

The rapid rise in interest rates and the slowdown in the tech sector were the culprits of the Silicon Valley Bank and other recent bank failures. High interest rates have hurt banks’ bond portfolios. The beleaguered tech companies had to withdraw more money than SVB had available.

This became clear to most people only later. But for the smart short seller, this was a special situation that they could foresee and take advantage of.

It’s not the first time something like this has happened, and certainly won’t be the last. In 2008, a handful of short sellers recognized the risks of the subprime mortgage market and understood that the epidemic could spread to the stock market and even beyond the United States. It’s a famous way to make a billion dollars. Mortgage bond swap market.

Going back further. George Soros shorted the pound by such a large amount to “crush the Bank of England” and force the UK to pull out of its efforts to peg its currency to the rest of European economies. The deal earned him $1 billion and made him one of the biggest gainers of all time.

And you can also look to Paul Tudor Jones, who made $100 million in one day during the Black Monday market crash.

Now, I wouldn’t recommend you start shorting stocks yourself. The first is that the market’s bullish bias is working against us. And second, shorting stocks is extremely risky for retail investors.

Shorting stocks involves borrowing stocks and putting them up for sale. If the stock price drops, you can make a profit by buying back the shares you sold. However, if it rises, you will be exposed to endless risks. This has caused many traders who failed to manage their risk properly to bankruptcy.

But everything I see points to more banking crises to come. Interest rates remain a major problem, especially for small and medium-sized regional banks. And my research shows that about 300 publicly traded regional banks are at high risk of suffering extreme losses in the coming months.

I want you to be victors, not victims of what is to come.

So here’s what I want you to do…

Short story “Off Wall Street”

As I said earlier, shorting stocks is very risky for retail investors who don’t have billions of dollars in hedge fund capital.

At the same time, the opportunities presented to us today cannot be ignored.

I have identified many of the unique circumstances in the current banking crisis as Paul Tudor Jones, George Soros, Michael Barry, and many others experienced before me. .

However, I do not encourage my subscribers to sell stocks short. The risks are too great.

Instead, I recommend something like this: Trade “Outside Wall Street” Few people know that…or if they do, they don’t know how to use it.

This transaction is not much different from buying stocks in a brokerage account. But, especially in times of volatility like the one we’re in right now, the multiples could rise faster than any stock position.

To give you an idea of the possibilities, here’s a deal I recently recommended to my subscribers.

On April 18th, I argued why the mainstream media is prematurely advocating an end to the banking crisis. Prices in certain niches of the banking sector did not reflect that, and the sector had (and still does) significant exposure to assets that were likely to lose value rapidly.

Therefore, I recommend trading against this sector.

Now let’s get this… 3 weeks and 2 days later I got exactly what I was looking for. Our goals continued to decline as the First Republic’s problems became more apparent. And we have earned more than 70% profit on some of our positions (the rest are still open for further profit).

As the banking sector continues to go through this difficult time, opportunities like this are limitless.

In fact, next week I will be releasing my latest findings on the current banking crisis, including nearly 300 banks that are currently at high risk of failing.

Alongside that, I’ll explain exactly what I plan to double up on. triple your subscribers money Because these bank failures continue.

To ensure access to this urgent information as soon as it is released, write your name here.

to get a good profit

Adam OdellEditor, 10x stock

Adam OdellEditor, 10x stock

Apollo is one of the largest and most successful private equity firm in the world. So when CEO Mark Rowan speaks, I tend to pay attention.

Earlier this month, Rowan said we could be headed for a situation like this: “Recession not recession”. This looks a little different than past recessions…many economists are scratching their heads.

A recession that isn’t a recession sounds like nonsense, but Rowan may really be on to something. He sees deflation in asset prices as hitting wealthy and upper-middle-class Americans in particular.

But other signs of a typical recession, such as soaring unemployment, may not be there. The unemployment rate is absurdly low at 3.5%, despite businesses reporting mostly sluggish earnings and weak outlooks.

When I was in college, my economics professors told me that “full employment” actually meant an unemployment rate of about 4%. Because there will always be some number of people between jobs.

That 4% is always an estimate and economics is not an exact science. But our unemployment rate of 3.5% is lower than generally thought possible, or at least sustainable.

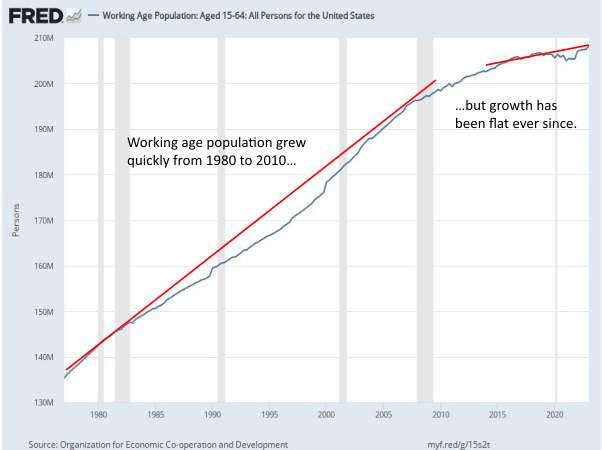

Again, it was also an era of population growth. Every year we have introduced new young workers into the economy.

In fact, that has not been the case over the past decade, as sharply declining fertility rates and declining immigration have slowed growth in the working-age population.

Therefore, it is very likely that widespread unemployment will not occur this time.

Hey, we accept whatever good news we get.

But “asset price” recessions are still no fun. We enjoyed 15 years of ultra-easy monetary policy by the Federal Reserve. This has disproportionately benefited the “investor class,” as the trillions of dollars created by the Fed and other central banks have pushed up the prices of stocks, real estate, and anything else that can be bought and sold.

And the “investor class” is not a group of old monopoly-man-like people sitting around a table smoking cigars and comparing golf handicaps.

If you’ve put a significant portion of your life savings into home equity or a 401(k) plan, you’re part of the investor class.

deleveraging Is painful. That means reducing debt in the face of rising interest rates.

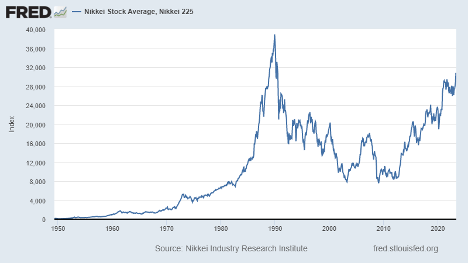

This has been the reality of Japan since the early 1990s. The Nikkei Stock Average has continued to fall almost continuously for more than 20 years. It finally turned around in the early 2010s, but still falls short of the highs of 30 years ago.

If you are an agile investor, this is not necessarily a concern. Short-term trading opportunities always exist, no matter what happens to the overall market.

As he said today, Adam O’Dell has identified ways in which he could make huge profits if, as expected, an asset price recession unleashed another wave of stress on the banking sector.

If you’d like to learn more, be sure to watch his new webinar launching next week, May 31st. Book your spot here.

And have a great weekend!

thank you.

Charles SizemoreEditor-in-chief, The Banyan Edge

Charles SizemoreEditor-in-chief, The Banyan Edge