Two of the main features of price charts that price action traders need to understand thoroughly are support and resistance levels and price action event zones.

Two of the main features of price charts that price action traders need to understand thoroughly are support and resistance levels and price action event zones.

You are probably more familiar with ‘support and resistance levels’ because they are one of the more basic technical analysis concepts and are very easy to understand.

However, the Price Action Event Zone (also known as the Event Area) is something I invented many years ago, so it may not be very familiar to you. But they are as important or even more important than standard support and resistance areas.

In today’s lesson, I wanted to explain these two parts of the technical analysis “puzzle” and help you distinguish between the two.

Elephants never forget, markets never forget…

Elephants are said to have the best memory in the animal kingdom. The market also has an amazing ‘memory’ that major turning points in price charts tend to carve out levels and zones that will remain relevant for months and years to come.

How many times have we seen the market turn around at virtually ’10 cents’ and then zoom out on the chart and see that same level a few years ago was also a big turning point? It’s the type of price action ‘footprint’ that you need to learn how to capitalize on.

I previously wrote an article on event areas titled “The Market Never Forgets” and I want to repeat exactly what these key areas on the chart are…

An event area (or zone) from which a clear price movement signal has formed or initiated a large directional (up or down) movement (e.g. a large sideways trading range breakout) It is the important horizontal area on the displayed chart. These event zones can and should be considered “hot spots” on the chart. It is an important area on the chart that should be closely monitored as the price moves back into that area in the future. We expect that the next time, or if the price visits these event zones again, the market will at least stop and ‘think’ whether to reverse direction there.

- An event zone is a signal area of major price action or a major breakout zone from a major level or consolidation.

- Support and resistance levels are apparent horizontal levels drawn on the chart connecting the highs or lows of bars at or near the same price level. These levels may remain relevant on the chart for days, weeks, or years, but overall they are less important than the price movement event zones. For more information, see my tutorial on how to draw support and resistance levels.

Price action event area

As explained above, the price action event area remains relevant even after being formed. If the market comes back and retests these areas, they become ‘hot spots’ and good areas of opportunity to look for second trade entry opportunities. So if you miss your first move out of the event area, don’t worry. There is usually another opportunity in the event zone and the market will be held tomorrow. Please do not forget.

Big and important events/movements on the price chart are remembered and other professional traders know this. These past event zones often become self-fulfilling turning points simply because many other traders expect the price to change there and are already waiting to buy or sell there. .

Let’s look at some chart examples.

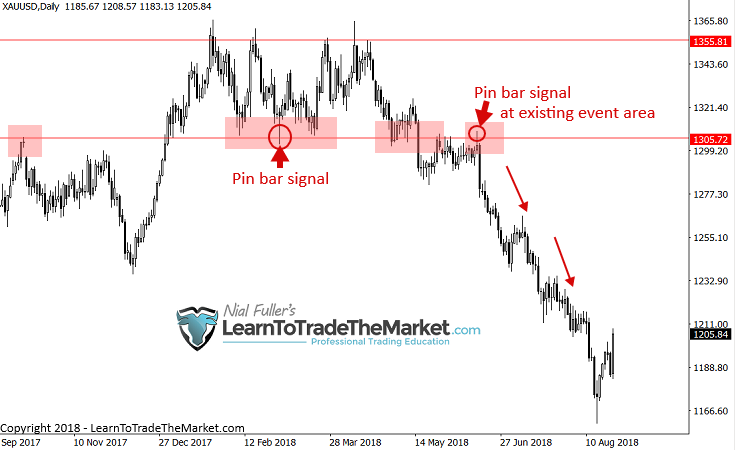

Perhaps the easiest way to understand the “price action event area” is through a clear and unmistakable event such as a pinbar signal. An event area exists at the level/area of signal formation when a clear price action signal is formed and the price follows through the signal in line and makes a strong move.

The important thing to remember about this is don’t worry if you miss the original event move. In many cases, you can get a second chance to enter simply by waiting for the price to return to the same event area. Blind entries can be made in existing event areas without the need for price action confirmation signals on retrace. However, it would be even better if the retrace gave another clear price movement signal, as in the example chart below.

The event area seen down to 1305.00 in Gold has solidified by both signals and breakouts. Notice that the first pinbar signal on the chart is just above that level. The price then finally broke out above 1305.00, further demonstrating that this level is a strong event level.

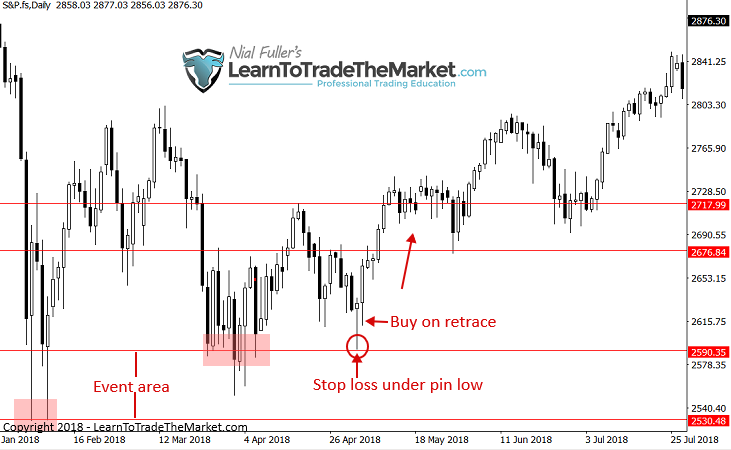

In the next event area example, we’ll look at the daily chart of the S&P 500. Note the formation of several long-tailed bullish reversals in early February after a strong descent, leading to a strong uptrend. The event zone was built at that time. You can now monitor that area as a ‘hot spot’ on the chart and monitor when the price moves back into that area again.

Notice the pinbar buy signal formed after returning to the event zone. With a confluence of event zones and a well-defined signal, this was almost a picture-perfect buy signal.

Support and resistance levels

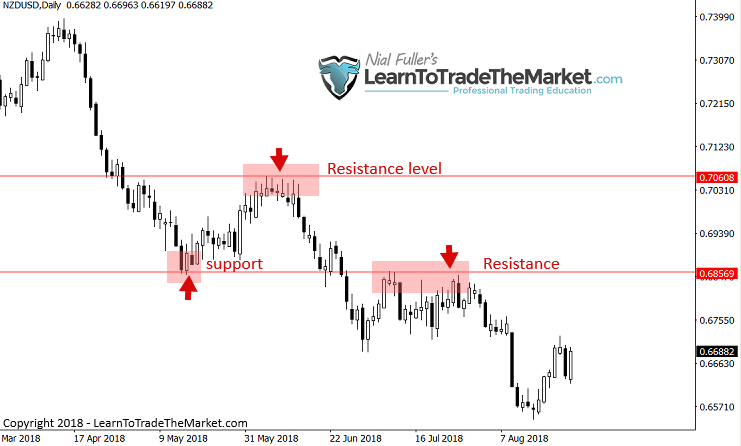

Support and resistance levels are simply horizontal levels on the chart that can be drawn across the highs and lows of a bar. Since there can be many support and resistance levels on the chart, we mainly focus on the more important levels.

I have created several tutorials on how to draw support and resistance levels and how experts draw support and resistance levels.

Notice in the example below that there are no obvious price movement signals and no strong breakouts from consolidation or levels. These levels are nothing more than standard support and resistance levels that are straddling the bar highs and lows.

Charts usually have much more standard support and resistance levels than event zones, even on daily timeframes and higher timeframes. The main point to understand about this fact is that event zones are more important as they reflect major price events, whereas support and resistance levels are usually drawn across smaller market turning points that are less important. It means that there is a possibility that Examples of standard support and resistance levels are shown below.

What are the main differences between the two?

The difference between event zones and standard support and resistance levels or areas may seem very subtle, but there is a difference.

In simplest terms, all event zones are also support or resistance levels/areas, but not all support and resistance levels are event zones.

Here’s how to distinguish between the two…

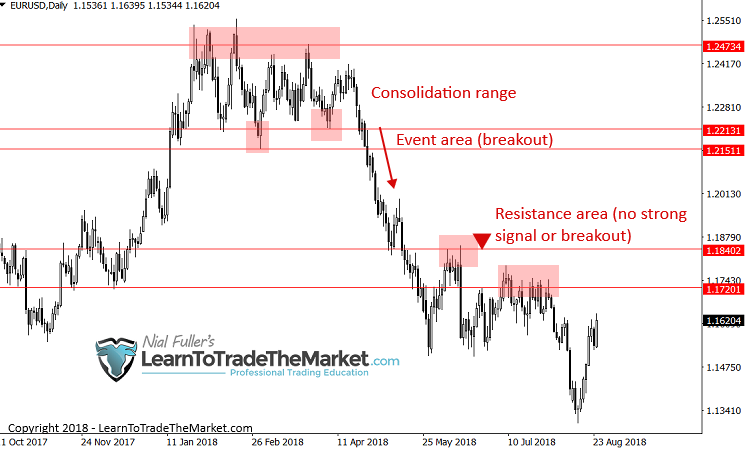

The event zone should have either a price action signal that led to a large move, or a large price breakout from a consolidation area or level. To demonstrate this more clearly, let’s look at some graph examples.

Here’s a clear example of an event zone. This was an event zone for the following reasons:

- It was an area where major breakouts occurred on the chart. Notice the long consolidating range before the breakout. So when that breakout finally happened, it was a strong price movement “event.” This level on the EURUSD chart could remain significant in the future.

Now let’s see a clear example of support and resistance levels drawn on the chart. These are not event areas for the following reasons:

- There was no long drop to breakout.

- There was no strong and bright price movement signal to initiate a strong move from these levels.

Event zones and support/resistance levels help define trade risk

Another important feature and advantage of event zones and support and resistance levels is that they help define trading risk. More specifically, it helps you decide where to place your stop loss and how to know when the market has disabled your trade idea.

Clearly, a stop loss can be placed where the price has crossed the support or resistance level. If the price violates that level, then the market is changing and it is unlikely that your original trade idea will work.

Event zones are often the more important support/resistance areas, so It’s an even better barometer of trade risk than the standard level. If the market breaks through the event zone, you know that your trade ideas are not working and market sentiment has changed significantly.

Risk can be further fine-tuned if there is a clear price movement signal/pattern in the event zone. Because these signals are often very high probability and you can place your stop loss on the high or low of the signal. And in many cases you can enter with a signal retrace. This is what I call the trade entry trick. This allows for potentially large risk reward trades.

Conclusion

To become a proficient price action trader, it is important to learn how to skillfully interpret and appropriately utilize money trails on charts., This footprint is left behind as price movements progress over time.

There are many different “tools” in the price action trader’s toolbox, and the ones I teach in my professional trading courses are (obviously) the ones I feel are the most important. Price action event zones and standard support and resistance levels are just as important as learning the signals and patterns for individual price action. Event zones and support and resistance levels play an important role in helping you understand the overall chart situation and the market dynamics that a particular trade has shaped. The interaction between the actual trading signals/entries themselves and the overall market conditions they shape constitutes high-probability trading opportunities. It’s not a simple “Oh, I have a pin bar, let’s replace it”.

Understanding the different pieces of the Price Action “puzzle” and fine-tuning your ability to trade properly can take years of screen time and experience. However, learning from tutorials like this and having a more structured price action trading education can go a long way in shortening the learning curve and reducing the time required to become a master price action trader.

Please let us know your feedback in the comments below 🙂