Now that the Federal Reserve has raised interest rates by 4.5% from early 2022, the highest level in 13 years…

Everyone I talk to these days asks: “I might buy bonds now? “

Short answer… it’s not.

The longer answer is… it’s not.

See, I can see why everyone is considering bonds right now, especially “No Risk” bonds and bills. Prices are falling and yields are rising.

However, government bond yields are still below inflation. Buying government bonds may be better than putting money in the bank, but that doesn’t mean it protects your purchasing power.

The point of income investment is generate incomeYou are not doing that when you lock yourself into negative real returns. you are losing income

That’s why I’m telling everyone I know to consider high dividend stocks instead of the Ministry of Finance.

Income from them is more stable against high inflation. and Interest rates rise even higher than bonds. Many high-dividend stocks offer yields well above inflation.

But the kicker of owning these assets is what they offer Further upside with capital gains.

In a volatile stock market, many people want to ask me about it.

So today I continue to argue against depositing money in US Treasuries.

I also share one of my shares Fortune in the Green Zone Portfolios ready for burst growth, offering stable, attractive yields.

Limitations of Bond Investment

While debating why I would prefer dividend-paying stocks to bonds, a colleague recently asked me, “Why buy stocks when you can get all the ‘legal protection’ that bonds offer?” is it?” I asked.

When he buys a bond, the issuer legal obligation You can also make the agreed-upon interest payments and return the principal at maturity. he is right about that.

It is also true that if the company goes bankrupt, the assets that can be sold for cash will be used to pay the bondholders. beginning. Equity investors only get paid if there is anything left after that.

These are attractive qualities…especially during a bear market.

But there’s a reason I’ve been busy building a portfolio of strong dividend-paying stocks. Fortune in the Green Zone Readers…and recommend Zero Bond.

And the reason goes like this Adaptive investment.

Adaptive investment It’s the core of what I do. This allows them to adjust to changing macroeconomic conditions.

Stocks excel in this flexibility. Bonds, on the other hand, are not.

If you buy a 30-year government bond with a yield of 3.8%… that is What You Get… 3.8% per annum for 30 years.

These conditions simply cannot accommodate high inflation over time. If inflation exceeds 3.8%, it goes negative. real Yields and purchasing power decline over time.

Needless to say, selling bonds before maturity often incurs penalties that can further damage your assets.

Quality dividend stocks, on the other hand, do not have these problems.

Unlike bonds, companies can Adapt to a world of persistently high prices. Higher input costs can be passed on to customers who adapt to pay higher prices over time.

As a result, quality companies maintain their margins and continue to generate revenue and cash flow. The company continues to pay dividends to shareholders, often increasing them (more on that later).

Then there’s the interest rate…

The relationship between bond prices and changes in interest rates is virtually fixed. When interest rates rise, bond prices rise. underBondholders are therefore at the mercy of changes in interest rates, for better or worse.

On the other hand, rising interest rates don’t necessarily hurt the prospects of good companies.

If a company has very little debt, or has fixed its debt at low interest rates for many years, higher interest rates will not have much of an impact.

And if the company’s customers continue to show strong demand for its products, they’re likely to buy just as much in a high-interest-rate environment.

And this is the biggest way dividend-paying stocks profit. growth.

High-quality companies tend to grow their revenues, profits, and cash flow over time. If management is friendly to shareholders, Dividends will also increase.

ABC’s bondholders will receive exactly the same income each year, shareholder $1 per share for the same company in the first year, $1.20 in the second year, $1.44 in the third year, and so on.

It’s dividend growth, and it’s sweet in and of itself. But even better is the fact that stocks provide capital gains.

Yes, bond prices go up when interest rates go down. You can sell the bond before maturity to make a profit and make a capital gain. But the upside potential for stocks is almost always greater than for bonds.

To prove it, let me share one stock from my Green Zone Fortunes income portfolio…

Yields beat inflation on strong energy stocks

I don’t normally do this…but I think it’s important to illustrate the kind of opportunities you may be missing out on by focusing on the treasury right now.

A few months ago I recommended Enterprise Product Partner (EPD) my Fortune in the Green Zone Subscriber.

EPD is one of the world’s largest and best energy infrastructure companies. Its more than 50,000 miles of pipeline carry natural gas, LNG, crude oil and refined products. It also manages billions of cubic feet of natural gas storage capacity and 19 deepwater docks.

Essentially, the company moves critical fossil fuel resources across the country for various service providers. About 80% of revenue is earned from fees for this service.

It’s a solid business that goes nowhere all the time. As I have said many times before, demand for US oil and natural gas is only accelerating. Service providers need to meet that demand by using companies like EPD to serve their customers.

So EPD has a significant tailwind in the form of the Super Oil Bull mega trend that I’ve been looking at all this year.

But what really makes this a compelling stock is its 7.2% dividend yield.

Its dividend, which is paid quarterly, is better than anything you can find in the US Treasury market. You can also beat inflation easily.

You should also know that an EPD is a Master Limited Partnership. This is another type of corporate structure that essentially allows companies to pay zero income tax, leaving more cash on hand to pay dividends.

It tracks payout history. EPD says he has increased his dividend for 23 consecutive years and has never missed a dividend payment in his 23 years.

Of course, EPDs are not risk-free like US Treasuries. So you should do your own research to make sure it’s the right kind of stock to own.

However, remember that “risk-free” returns come with their own limitations and costs. EPDs offer both inflation-beating yields and a strong business that will continue to deliver yields for years to come, with capital gains in the process.

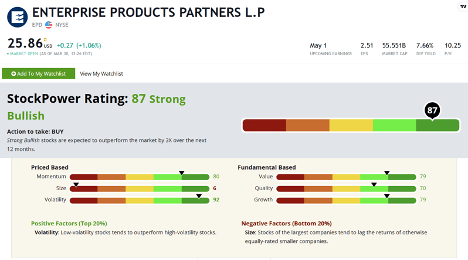

The Stock Power Rating System agrees with this, ranking it at a strong bullish 87.

The only thing that can be said about the EPD is its size. With a market cap of $55.5 billion, this stock is not necessarily a multibagger stock.

But that size also comes with reduced volatility. This is what we look for in stocks with strong yields.

Now, why bother sharing the EPD with you, especially given that it’s within my recommended pricing guidance? Fortune in the Green Zone Subscriber?

Because I want to give you an idea of what is possible with income investing once you open your mind to opportunities outside of the US Treasury.

Especially if my Stock Power Ratings system excludes only the largest dividend stocks.

EPD is one of them. 17 other dividend stocks Inside me Fortune in the Green Zone The portfolio is designed to help you outpace inflation and grow your capital at the same time.

Editor-in-Chief Charles Sizemore helped design this portfolio a few months ago.You can learn more about this project directly from Charles Here.

nice to meet you,

Adam OdellChief Investment Strategist, money and market

Adam OdellChief Investment Strategist, money and market

Yesterday I got a cortisone injection in my right shoulder. I was told it would take a few days to see results. But my shoulders are throbbing and I’m so miserable that I can’t do it any time soon.

It appears that at some point in the last 20 years, he partially tore his rotator cuff ligaments. And like the typical man, I ignored the occasional flare-ups, assuming the pain would go away.

And that was… until next time I lifted something too heavy… I tried to shoot too many three pointers. Or tried to throw my son, who is now 90 pounds, into the pool.

And my shoulder was so inflamed that I could barely move and was back in the starting position.

After finally going to a specialist, I had good news. No surgery required. But if I had seen a doctor years ago, my physical therapy would have been less intensive. Time would have been on my side. However, I let this go on for too long and as a result my shoulders are really messed up.

I tell this sobbing story for a reason. Managing portfolios is very similar.

How to avoid small mistakes

You make mistakes and things break. It is inevitable and happens to all investors. However, if you fix the problem early, you can minimize the damage.

stop loss (and risk management in general) is a great solution here. By implementing a stop loss on your position, you can minimize your risk and set your price first — on what you are going to lose on the trade.

A 10% loss can be recovered much faster than a 50% loss.

But risk management goes deeper.

Consider your investment style. Perhaps you are making a decent profit, but due to some inefficiencies in trading, you are making a few percentage points less profit than you could possibly make.

In a year it doesn’t really matter. Making the 5% vs. 7% is not going to radically change your life. but, 30 year windowit is important.

Example: $1,000 invested at 5% for 30 years equals $4,321.

At a rate of 7%, it grows to $7,612. Full 76% or moreAgain, this is due to a 2% improvement in annual returns.

This is why I always liked how Adam O’Dell traded.

He never rests on his laurels. He’s always trying to build that proverbial “better mousetrap.” And in his ten years since I’ve known him, he’s gotten better at his job year after year.

Adam mentioned one of my all-time favorite income stocks, Enterprise Products. I’ve personally owned it for years and the quarterly distribution averages me out to new stocks.

If you like looking for income stocks like this, I’ll send you:

- a 1 “certainty” Dividend stock play.

- a 6% “Bulletproof” Income Stock Play.

- my Top 3 Dividend Boosters

You will see these 5 recommendations For free with a subscription to Fortune in the Green Zone.

and, moreover To invest your resources, check out Adam’s Stock Power Ratings system. money and marketIt’s a free tool.

You can enter the ticker of any stock that trades in the US (and many stocks that trade internationally!). Scores are displayed based on the stock’s value, momentum, growth rate, volatility, quality and size.

Play it over the weekend. The following enterprise products may help you fund your retirement.

nice to meet you,

Charles SizemoreEditor-in-chief, The Banyan Edge

Charles SizemoreEditor-in-chief, The Banyan Edge