It’s classic Washington accounting.

They flaunt big numbers and predictions and promise to spend big bucks today It will somehow save you money in the future.

But the problem is… Washington will always underestimate Actual cost to American taxpayers.

And it’s happening again with the 2022 Inflation Control Act.

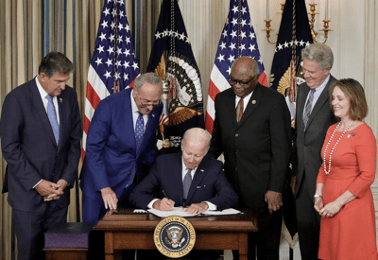

In August 2022, President Biden signed into law a 725-page law.

This was the most important action Congress took on clean energy and climate change.

with what of wall street journal The Congressional Budget Office estimated that the bill would cost Americans only $391 billion.

In reality, it could cost about three times that, or $1.2 trillion.

This is according to a recent Goldman Sachs valuation.

That means this new law could cost you and me tens or hundreds of billions more than the Congressional Budget Office (CBO) estimates over the next decade.

CBO fell short of some expectations.

Because in reality, we end up spending…

- Another $379 billion for electric vehicles (EVs).

- An additional $156 billion for green energy production.

- An additional $82 billion in renewable power production.

Over the next decade, this program will effectively triple or $1.2 trillion more than Washington voted into law in the first place.

But while green energy will be boosted by the IRA, oil and gas companies will spend less. This is a big long term problem.

Doubling of fossil fuels

President Biden told the American people how green energy is the way of the future. And he yells from the roof that fossil fuels are disappearing.

But the bottom line is that President Biden knows we can’t do anything without fossil fuels.

In an unscripted moment in his State of the Union address, he admitted that he would need oil and gas “for at least another decade…and beyond.”

The Energy Information Administration goes further, stating that by 2050 oil will still be the largest source of energy.

While Washington is buzzing over the demise of fossil fuels, some of the world’s most successful investors are betting that oil and gas will rise.

Smart money is in oil and gas

While Washington was busy pitching its green energy agenda in 2022, Warren Buffett was busy buying hundreds of millions of shares in two major oil companies.

He has invested a total of $40 billion in Chevron and Occidental Petroleum. It’s one of the biggest investments he’s made in years.

In fact, Buffett recently bought an additional 3.7 million shares, taking his ownership to 23.5%.

Legendary investors such as Karl Yichan, David Tepper and Ray Dalio have also invested in oil.

You have to ask yourself — what do all these billionaires know that Washington doesn’t?

This is the true story….

I think oil is in a bull market for years, maybe decades.

China is reopening its economy after three years of lockdown.

India is on the rise and is the fastest growing country on earth.

And President Biden has backtracked on his promise to kill the fossil fuel industry, forcing major projects in California, Alaska, and offshore Texas.

Meanwhile, OPEC is cutting production by 2 million barrels per day.

And after years of political headwinds, there is no way US and European oil companies can expand production fast enough to keep up with demand.

If, like me, you think oil could start getting more expensive soon…

And you realize this is a great long-term investment that will pay off for years to come…

Then I would like to invite you to join me today in a special presentation I am holding called the 10X Oil Boom.

Let me show you how oil prices have already gone up 1,000% in the last 50 years.

The presentation starts in just a few hours — 4:00 PM ET.but i have my banyan edge This is your last chance to subscribe.

Click here to enter your name. See you soon.

nice to meet you,

Charles Mizrahi

Founder, alpha bester

$3,000 outflow…

The real estate market is tough for both buyers and investors.

I just got a bill from an electrician for $3,000.

And to my surprise, I was happy to pay for it. I’m pretty sure the guy is robbing me blindly, but the first guy I called gave me a quote of nearly $7,000.

What’s wrong with my electrical system?

Your guess is the same as mine. I have lived in the house for 11 years and have noticed the lights flickering. I never gave it much thought. The house was built in the 1950s and I think there is a certain amount of weirdness about old houses.

But now that I’ve rented out the house, my tenant is hysterical – I’m afraid it will burn out. I noticed.

Fencing will be replaced soon. When I bought the house it wasn’t in good shape, but I figured it was an easy fix. I cleaned it out with a pressure washer for a few hours and tightened up some loose boards with a hammer.

And that was… but that was 11 years ago now. It will cost him another $20,000 to upgrade the fence to the neighborhood’s current standards.

Air conditioner?

It was new when I bought it. And I can probably squeeze five more years out of it… more with any luck. But it won’t last forever either.

And plumbing?

I’ve managed to avoid clogged toilets in the 11 years I’ve lived in this house (I have 3 young children, by the way). Still, it sounds like you have to pay the plumbing bill every 2-3 months.

It’s really always something.

But I’m glad I still own real estate because I like to spread my bets. I write about and invest in the market for a living.

So having a real asset like a rental home is a great diversifier. I’d like to buy a few more when the price drops enough for the numbers to work.

But let me be clear. We have a property management company handle most of the day to day painstaking work, but dealing with all this is a tremendous pain in the rear. If all my investments were like this, I’d accept a life of poverty and avoid investing forever.

I like—and maybe need — Most of my investments are stress-free. And I was able to arrange my financial life to allow for that.

Given the current fragile state of the banking system, I have been writing a lot about gold lately.i have a stash of gold coin I’m locked in a safe deposit box. they don’t make me sad They just sit there and are available if needed.

I also have a core portfolio of stocks that I plan to hold indefinitely unless some unknown future catastrophe occurs. I don’t mind the drop.

That is also Charles Mizrahi’s strategy. I have known Charles for many years, I never have I saw him look worried. Not once. He knows the business inside and out so you don’t have to worry about him.

I will be straight with you. I’m not so bullish on the overall market right now. I tend to agree with Mike Kerr that the recent financial sector turmoil looks more like Bear Stearns than Lehman Brothers.

But we also know that these market downturns create great opportunities, just like the oil industry. There is a possibility that you can get a good company at a good price, and Make the right investment for a good night’s sleep.

nice to meet you,

Charles SizemoreEditor-in-chief, The Banyan Edge

Charles SizemoreEditor-in-chief, The Banyan Edge