Small retail investors like you and me don’t have many advantages over large institutional investors.

But as counterintuitive as it may sound, our small size is huge.

Institutional investors have abundant funds. They can fund research teams with dozens of PhDs, and they can fund lobbyist groups that work to bend regulation in their favor.They can co-locate their tech with exchanges… sure their Your orders will be filled faster than us and at a better price.

The list goes on…and makes for compelling rebuttals.

But my friend and colleague Mike Carr recently made a great point. You and I Claim We’re Not Warren Buffett… So We Shouldn’t try be able to.

Mike says that because Buffett is one of the biggest money managers in the game, he has access to opportunities that “little guys” like us could only dream of.

Think of it this way… when the banking crisis erupted in mid-March, more than a dozen private jets reportedly landed in Omaha.number of landings outside your House?

Even if you can’t invest like Warren Buffett, Our small size gives us opportunities he could never touch.

The Oracle of Omaha once acknowledged this, stating:

Anyone who says size doesn’t hurt investment performance is wrong. The best rate of return I ever achieved was in his 1950s, but at the time I was investing in peanuts.

This is a great structural advantage. no to have a lot of money

You see, Buffett manages hundreds of billions of dollars. I mean, he can’t touch a “small” stock with his 10 foot pole. hope To.

This is a boon for small investors. That means there’s a whole sector of investment opportunities that can have a big impact on your wealth early on… and even greater impact Once those stocks grew enough to attract the attention of institutional investors.

And who do we have to thank but the SEC for providing the best of these opportunities…

Small Caps and the $5 Rule

Nearly a century ago, the SEC enacted a frankly ridiculous rule. This makes it a real pain for large investors to buy certain classes of small-cap stocks.

(If you’re already familiar with small caps, skip ahead to the next section that covers this rule in detail. Otherwise, read on as a quick primer.)

Stocks are typically categorized by market capitalization or “market cap.” The market capitalization of a stock is simply the price per share multiplied by the number of shares outstanding.

Stocks with a market capitalization greater than $10 billion are considered large-cap stocks. $2 billion to $10 billion make up the mid-cap category. This is a sandbox where big money works.

$250 million to $2 billion is the ‘small cap’ space. Also, companies with a market capitalization less than his $250 million are called microcaps.

Virtually the entire micro- and small-cap category is off-limits to Buffett and his peers. Even if there are tempting opportunities out there, he knows his investment is too small to be a problem…or invest a sizeable amount of capital and he’ll move the market.

After all, Buffett knows he can’t get his hands on small caps. I doubt he even cares to see them these days.

Of course, Buffett is just the epitome of a large institutional investor. that’s all one.

Hundreds of mutual funds, hedge funds, pensions, endowments and insurance companies face the exact same “scale penalties”.They are Too big Invest in the best small caps.

Many of these large investors have strict rules written into their charters and powers of attorney. restrict Keep them away from investing in companies that are too small based on market capitalization or price per share of stock.

In fact, one of the “most ridiculous” but highly exploitable anomalies related to stock size is what I call the “five dollar rule.”

Abusing the $5 Rule

The $5 Rule dates back to SEC rules created in the 1930s and creates additional hurdles that institutional investors must jump to purchase stocks priced below $5 a share.

The $5 threshold is completely arbitrary, as far as I can tell. There is no meaningful difference between the $4.99 stock and the $5.01 stock.

But in the eyes of the SEC and institutional investors subject to the $5 Rule, teeth difference.

Stocks above $5.01 are “fair game”. Stocks below $4.99 are effectively “off limits.”

That’s why I say that small people like us have an advantage over big people.. If you find a good company with a share price of less than $5, you can buy it as easily as a stock trading at $50.

The stock is trading below that threshold, but there’s little competition from the Wall Street machine and its biggest players.

Most financial institutions don’t touch stocks below $5. That’s why many analysts don’t bother to cover it.

And that arbitrary $5 rule leaves a mountain of quality companies that go unnoticed, undiscovered, or go untouched simply because they’re “too small.”

And here is the most beautiful part…

If a stock previously below $5 crosses over it That threshold… Wall Street handcuffs are off. Analysts, Portfolio Managers, and Allocators can all rejoin.

And when they do, prices can rise dramatically, sometimes in unison.

At this point, investors who read too much of Berkshire Hathaway’s annual letter may be reading this and snorting at the risks associated with small caps.

uhm, you are right. Those risks exist.

But if you invest the way I do, you’ll know how to mitigate those risks…and find only the small cap stocks that have the best chances of success.

The Right Way to Find Good Small Caps

Most academic research has focused on market capitalization as a measure of size rather than price per share, but there is considerable overlap.

Stocks that trade at less than $5 per share are typically on the lower end of the market capitalization spectrum.

In fact, investing in small-cap stocks is risky. Compared to large companies, small companies typically have the following characteristics:

- A smaller capital base and less ability to deal with economic uncertainty.

- Highly volatile earnings.

- Increased cash flow uncertainty.

- Less depth of control.

- A business model with a poor track record (in some cases).

- With fewer analysts covering them, less information is available.

- Stock price volatility increases.

Unless, of course, for some reason you believe in the “free lunch”, the inherent risks involved in investing in small businesses are To be exact why Investment in SMEs higher return.

In the long history of the market, Small caps outperform large caps.

Numerous research studies on US and foreign developed and emerging market equities show this to be true.

It also applies to different time frames, some dating back to the 1920s.

Of course, US large-cap and mega-cap stocks have performed wonderfully in the mid- and late-stages of the last bull market. That’s why everyone I talk to long run Advantages of acquiring a small business.

It’s also why I’m on a mission to educate my readers about this advantage…and why I bias the portfolios I build with stock research services— Fortune in the Green Zone and 10x stock — on the “small” side.

especially since now that is Perfect When to Build an Overweight “Small Cap” Portfolio…

Small-cap stocks in general, and low-quality small-cap stocks in particular, tend to experience significant volatility during bear markets and recessions…

Its volatility is buying opportunityespecially in the type of high quality Small-cap companies that tend to outperform like gangbusters in the aftermath of recessions.

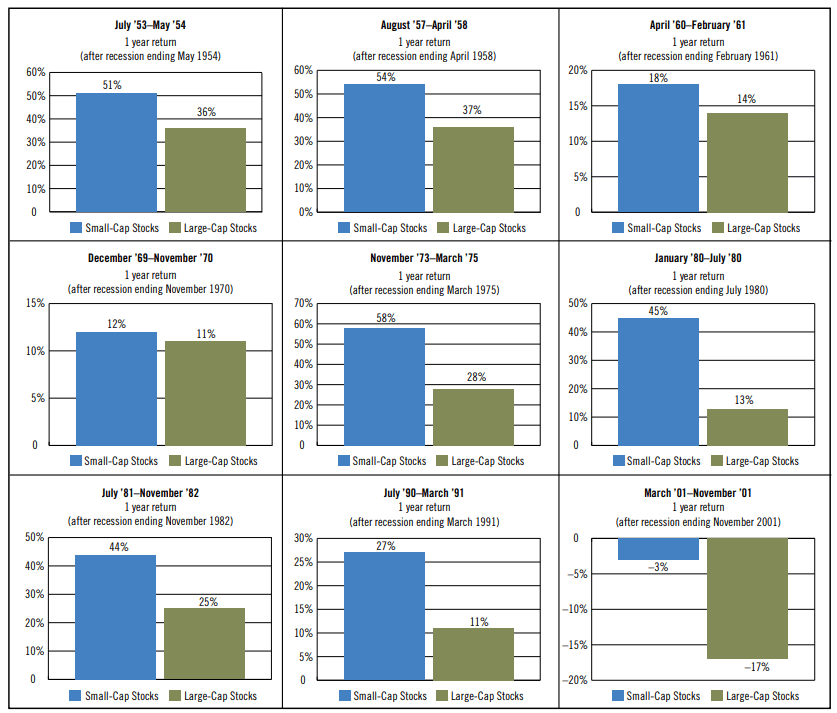

Consider this chart from prudential research,this is Small caps continue to outperform large caps Nine recession…

That’s why I’m gearing up for what I expect small, quality companies to significantly outperform in the next couple of years.

The bear market has created a once-in-a-decade opportunity to buy small businesses at deep discounts. Many of them can be purchased for less than $5 a share, Wall Street’s “no trespassing” threshold.

You can also use our Stock Power Ratings system to screen only the highest quality small caps from stocks with more risk than reward.

More details will be shared soon. But there is an important point here.

These opportunities are totally absent from Warren Buffett and his friends…

It’s for “little people” like you and me.

And I don’t know about you, but I’m ready to swoop in and take advantage of it!

nice to meet you,

Adam OdellChief Investment Strategist, money and market

Adam OdellChief Investment Strategist, money and market

PS In the coming weeks, we’ll share more about our research to date on small caps below $5. Completely free to share, including potential candidate reports.

We’re working on the final list now, but it looks like there are over 300 names you can check out.

In the meantime — tell me, did I sway your opinion of small caps if you had a negative opinion in the first place?

Write your thoughts to BanyanEdge@BanyanHill.com.

yesterday cornerMike Carr described last month’s bank scare as a “black-necked swan” rather than a black swan.

meaning it Looked Like a horrific, far-reaching event in the banking sector. But upon closer inspection, it’s unlikely to blow up the world.

I actually agree with Mike.

However, it is not without results.

A banking system obsessed with strengthening its balance sheet and preventing a massive outflow of customers no A banking system that makes loans.

And non-disbursement represents a business that may not have the capital it needs to launch, grow, or add staff.

It’s too early to say with certainty, but the first unemployment claims appear to have occurred in March.

We’ll know more when April data comes in.

The economy may still have enough momentum to fend off the impact of bank tightening. But as I’ve been writing all year, the yield curve has reversed significantly, which has historically been a predictor of the pending recession.

It’s not hard to see the March bank crash as the catalyst that will ultimately lead to a recession.

Let’s see. In the meantime, we still have to take advantage of this market opportunity.

Adam makes a great historical point about how small caps perform in recessions. Ian King made a similar finding that supports that idea. Like when he gave five reasons to buy small-cap stocks in a bear market in January.

Like Adam’s upcoming report on small caps below $5 (something you don’t want to miss), Ian also knows the value of small caps.in him extreme fortune For example, he investigates this market capitalization technology company in a disruptive market. And they are preparing to soar to 500% of him, up to 1,000% in a few years.

For more information extreme fortune, Visit here to watch Ian King’s free presentation on the next “convergence” in a small cap.

Next week, we’ll dive deeper into Adam O’Dell’s $5 small cap play.

nice to meet you,

Charles SizemoreEditor-in-chief, The Banyan Edge

Charles SizemoreEditor-in-chief, The Banyan Edge